47% of Americans Now Use AI for Holiday Shopping—Here's What They're Buying

The holiday shopping season is here, and this year looks different from anything we have seen before. Visa just released a major study that shows how Americans are changing the way they shop and pay for gifts. The findings reveal something surprising: AI tools, digital wallets, and even cryptocurrency are becoming normal parts of holiday shopping.

The research covered 12,000 people across 12 countries, including the United States. What they found shows a clear picture of where shopping is heading. Nearly half of American shoppers are already using AI to find gifts and compare prices. Younger generations are treating digital payments as their preferred choice. Even digital currencies are showing up as holiday gifts.

This report covers everything from how people use AI for shopping to security concerns and payment preferences. Let's explore the key findings and understand what they mean for holiday shoppers this season.

Let's get into it.

Executive Summary

A new study from Visa reveals major shifts in how Americans shop and pay during the 2025 holiday season. Nearly half of U.S. consumers are now using AI tools for shopping tasks, while younger generations are normalizing digital currencies and mobile payments. The research surveyed 12,000 people across 12 countries between October 14-16, 2025.

Key Findings:

- AI adoption hits mainstream - 47% of Americans have used AI for gift ideas, price comparison, or product research

- Digital currencies gain ground - 45% of Gen Z would welcome cryptocurrency as a gift, compared to 28% of all Americans

- Digital wallets rise steadily - One in five shoppers now prefer digital wallets, with Gen Z split evenly between wallets (36%) and physical cards (34%)

- Security tops priorities - 79% rate security as extremely important, while 82% have activated protective measures

- Gen Z drives change - 60% shop internationally and 41% plan increased holiday travel

Countries like Singapore, UAE, Brazil, and Mexico show the highest enthusiasm for these payment innovations, while traditional markets like Germany remain cautious.

What Are People Actually Using AI For?

AI shopping tools are no longer just for tech fans. Americans are turning to these tools for everyday holiday shopping tasks. The research shows that 47% of U.S. shoppers have already tried AI for at least one shopping activity this season.

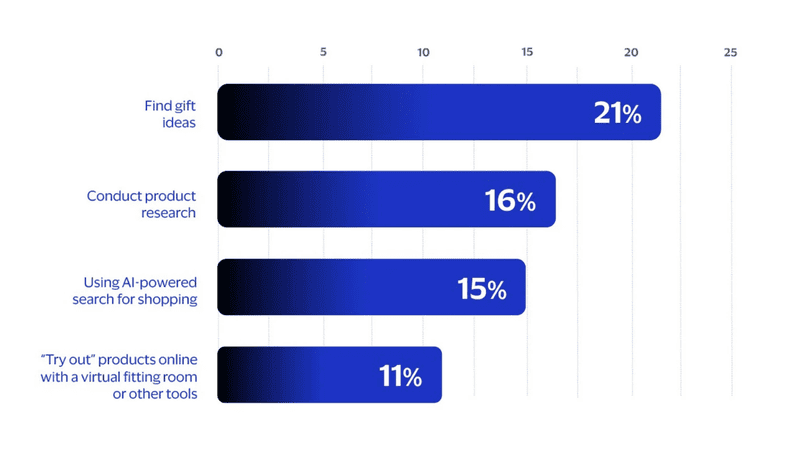

The most common ways people use AI include:

- Finding gift ideas - Getting suggestions based on the person they're shopping for

- Comparing prices - Checking which stores offer the best deals

- Researching products - Reading reviews and learning about items before buying

These tools help shoppers save time and money during the busy holiday season. Instead of visiting multiple websites or stores, people can get answers quickly through AI assistants.

The trend is not limited to the United States. Countries like Spain, Singapore, South Africa, UAE, Brazil, and Mexico show even higher rates of AI adoption for shopping. Shoppers in these markets are particularly open to using new technology to make their holiday purchases easier.

This marks a clear shift in how people shop. AI is moving from being a novelty to becoming a standard shopping tool that many people use regularly.

The Crypto Surprise

Digital currencies are becoming acceptable holiday gifts, especially among younger people. The research reveals that 45% of Gen Z Americans would feel excited to receive cryptocurrency as a gift. This number is almost double the general population, where only 28% share the same enthusiasm.

Stablecoins are also gaining attention. These are digital currencies that maintain a steady value, unlike regular cryptocurrencies that can change dramatically in price. They work similarly to digital dollars, making them more reliable for sending money across borders.

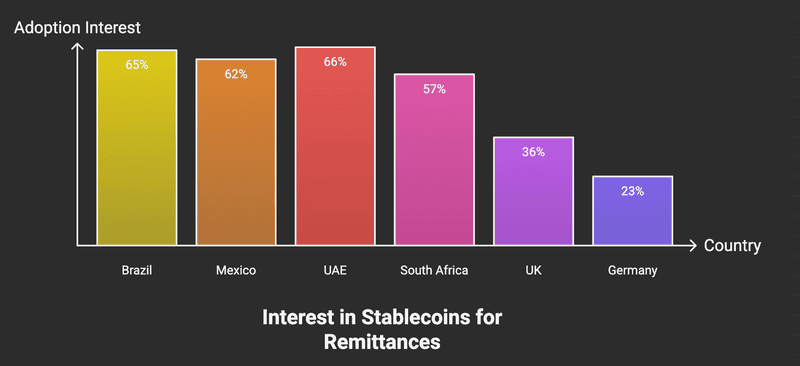

The trend shows strong regional differences:

- Brazil leads with 65% of remittance users willing to try stablecoins

- Mexico follows at 62% adoption interest

- UAE shows 66% openness to using stablecoins

- South Africa reaches 57% potential adoption

- UK displays moderate interest at 36%

- Germany remains cautious with only 23% interest

About 41% of U.S. remittance users plan to use stablecoins for international money transfers. Younger generations grew up with digital payments and online banking, making the jump to digital currencies feel natural. They view crypto as another payment option rather than something unusual or risky.

Digital Wallets Taking Over

Credit cards are not disappearing, but payment habits are changing. One in five American shoppers now prefer using digital wallets over traditional payment methods. This shift is happening gradually as more people discover the convenience of paying with their phones.

Gen Z shows the most balanced approach. They use digital wallets and physical cards almost equally, with 36% preferring wallets and 34% choosing physical cards. This near-even split shows how younger shoppers view both options as normal ways to pay.

Payment preferences vary greatly by country:

- Singapore and UAE lead globally - Digital wallets beat cards and cash on trust, security, speed, and convenience

- Brazil shows strong preference - Driven by widespread acceptance and faster checkout times

- Germany stays traditional - Cash remains the top choice for most purchases

- UK leads Europe - More digital wallet experience than other European markets

The change is not happening overnight. Many people still carry physical cards and use them regularly. Even in countries where cash stays popular, people expect its use to decline over the next ten years. Digital wallets are becoming one more option in how people choose to pay.

But Wait - Is This Safe?

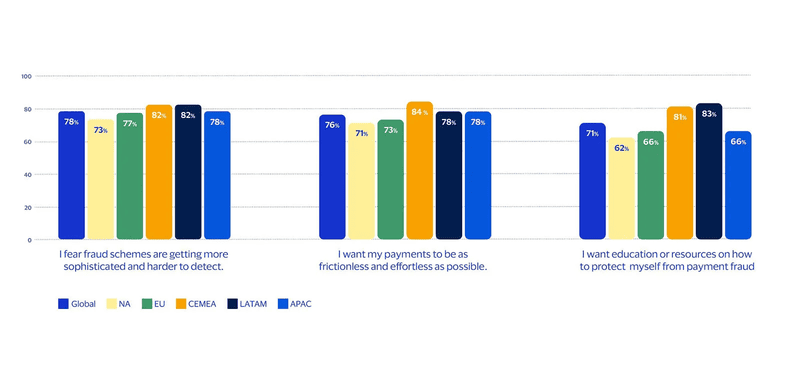

Security remains the top concern for shoppers trying new payment methods. The research shows that 79% of people consider security extremely important when choosing how to pay. This makes it the single biggest factor influencing payment decisions worldwide.

American shoppers feel particularly worried this holiday season. About 66% fear that their friends or family members might fall victim to online scams. These concerns are not without reason, as fraud schemes continue to become more sophisticated.

People are taking action to protect themselves. The study found that 82% of Americans have already put safety measures in place, including:

- Using two-factor authentication for account logins

- Changing passwords frequently to prevent unauthorized access

- Monitoring account activity regularly for suspicious charges

Fraud exposure varies significantly across regions. Countries in Central Europe, Middle East, Africa, and Latin America report the highest levels of online payment scams. European countries show the lowest fraud rates overall.

This creates a clear tension. Shoppers want payments to be quick and easy, but they also want strong protection against fraud. The challenge is finding the right balance between convenience and security while adopting new payment technologies.

Gen Z Is Changing Everything

Gen Z shoppers are reshaping how the world buys and pays for things. Their preferences today are becoming the standard for everyone tomorrow. This generation treats digital wallets and physical cards as equal options, showing no strong preference for traditional payment methods.

Their shopping habits extend far beyond local stores. About 60% of Gen Z shoppers worldwide are buying holiday gifts from overseas retailers this season. They browse international websites as easily as local ones, making cross-border shopping feel normal.

Key differences in Gen Z behavior include:

- Embracing digital gifts - Viewing cryptocurrency as an acceptable present

- Using social platforms - Making purchases directly through social media apps

- Prioritizing experiences - About 41% plan to travel more this holiday season compared to last year

This generation grew up with smartphones and digital payments as part of daily life. What seems new or unusual to older generations feels completely natural to them. Their comfort with technology is pushing businesses to offer more digital payment options and better online shopping experiences.

The patterns Gen Z sets now will influence how everyone shops in the coming years. Their preferences are not just a phase but a preview of mainstream shopping behavior.

What This Means for You

These changes in shopping and payment habits affect everyone, even if you are not ready to try new methods yet. Understanding these trends helps you make better choices about how you shop and pay.

If you want to try new payment methods, start slowly. Set up two-factor authentication on all accounts before using digital wallets or online payment tools. Check your bank statements regularly to catch any unusual activity early.

Practical steps to take now:

- Learn about your options - Explore what digital wallets or payment apps your bank offers

- Update security settings - Enable all available protection features on existing accounts

- Stay informed - Watch for new scams targeting holiday shoppers

- Test carefully - Try new payment methods with small purchases first

Businesses are already adapting to these changes. Stores are adding more digital payment options at checkout. Online retailers are improving their security features. Customer service teams are getting better at handling digital payment issues.

Even if you prefer traditional payment methods, knowing what options exist helps you understand what your children or grandchildren are using. This knowledge makes it easier to spot potential scams and give good advice about staying safe online.

Comments

Your comment has been submitted