OpenAI Funding Secrets: The $100B Tech Breakthrough Revealed (And IPO News)

OpenAI is about to raise $100 billion in what could be one of the biggest funding rounds in tech history. This massive cash injection comes at a critical time when the company is burning through billions while racing to build the future of AI.

But here's what makes this story interesting: OpenAI's CEO Sam Altman recently shared some surprisingly honest thoughts about going public. He admitted he's not excited about becoming a public company CEO, yet an IPO seems inevitable.

So what's really happening behind the scenes? Why does a company making $20 billion a year need another $100 billion? And what does all this mean for you as a ChatGPT user?

In this article, we'll break down the $100 billion fundraising plan, explore Sam Altman's candid IPO comments, reveal what changes are coming to ChatGPT, and examine the risks OpenAI faces in an increasingly competitive AI market.

Let's get into it.

Executive Summary

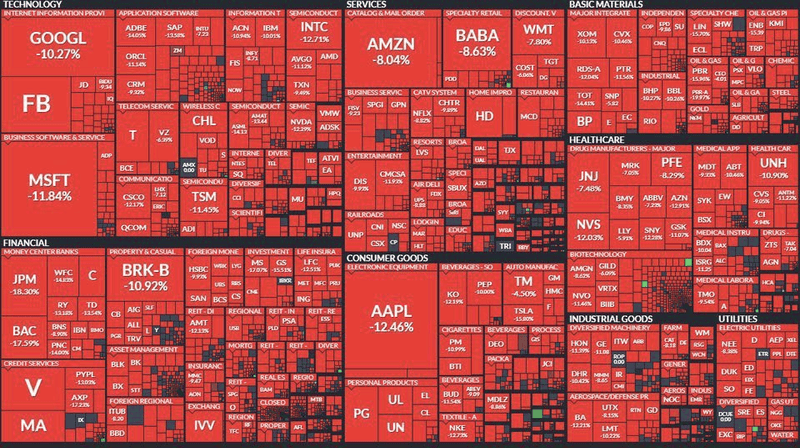

OpenAI is raising up to $100 billion by Q1 2026, potentially valuing the company at $750-830 billion. Despite generating $20 billion in annual revenue, the company faces $5 billion in losses and needs massive capital for AI infrastructure spending.

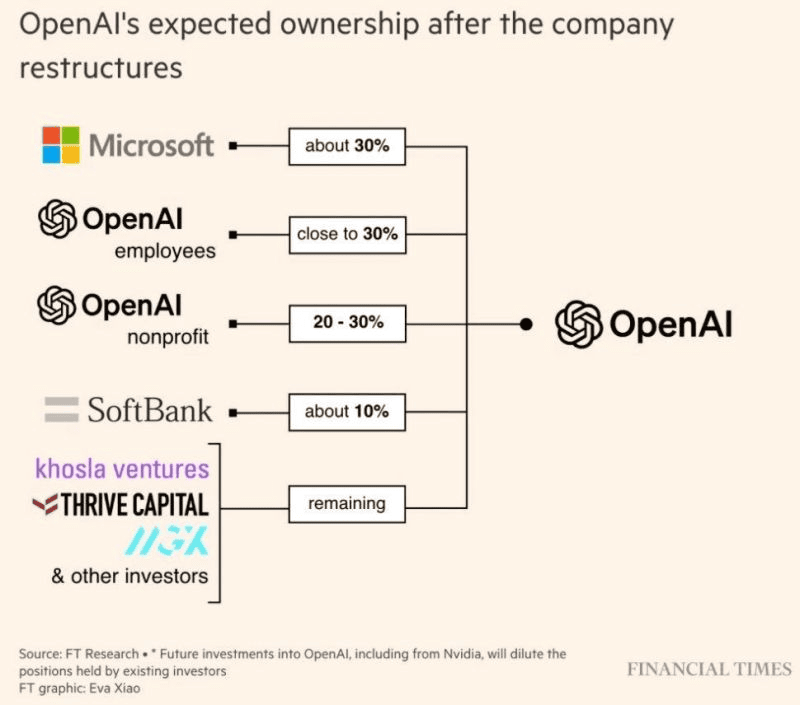

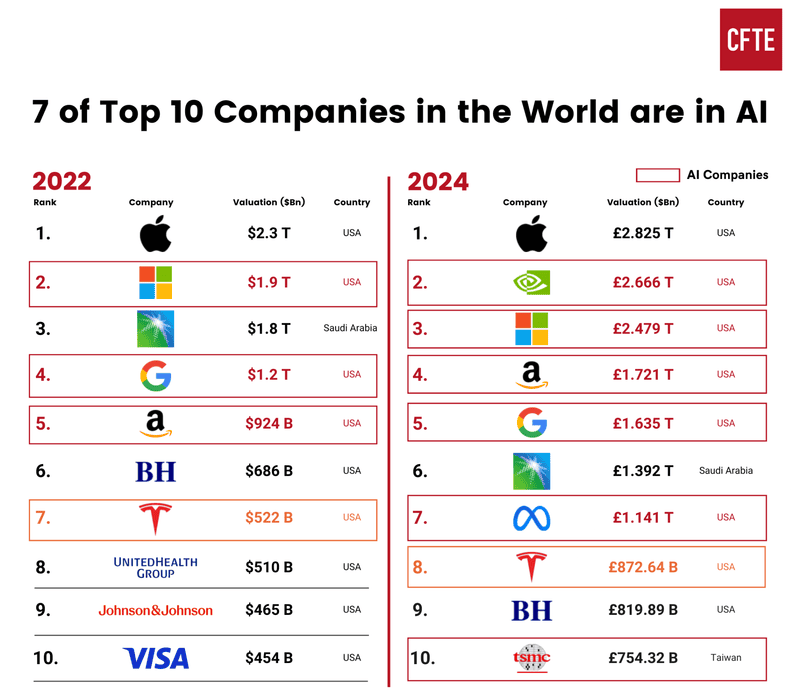

The company completed a major restructuring in October 2025, transforming into OpenAI Group PBC controlled by the nonprofit OpenAI Foundation. This new structure removes profit caps for investors, making the company more attractive for fundraising and a potential IPO.

Major financial moves:

- Microsoft holds 27% stake worth $135 billion

- SoftBank led historic $40 billion funding round in March 2025

- CFO targeting 2027 IPO that could raise $60+ billion at $1 trillion valuation

- Amazon negotiating $10 billion investment tied to AI chip usage

OpenAI plans to introduce ads and shopping features in ChatGPT to generate more revenue directly from users. The broader AI market shows mixed signals, with Nvidia reaching $5 trillion valuation while memory chip shortages and cooling investor sentiment create significant challenges ahead.

What's the Big News About OpenAI's Latest Fundraising?

OpenAI, the company behind ChatGPT, is planning to raise up to$100 billion in new funding. This fundraising round is expected to close by the end of the first quarter in 2026. The move comes right after the company finished a major restructuring of how it operates.

This massive funding round could push OpenAI's value to impressive heights. Different sources report different numbers, but the company could be worth anywhere between $750 billion and $830 billion after this investment.

Here's what makes this fundraising different:

- The investors: OpenAI is targeting sovereign wealth funds, which are investment funds owned by entire countries

- The timing: The company wants to complete everything by March 2026

- The scale: $100 billion is one of the largest funding rounds ever planned in tech

- Current position: OpenAI already has more than $64 billion in its accounts

The company plans to use this money to build more AI compute power and expand its operations worldwide.

Why Does OpenAI Need Another $100 Billion?

Image credit: New York Times

OpenAI is spending money faster than it's making it, even though the company brings in about $20 billion per year. The problem is simple: building and running AI models costs an enormous amount of money, and those costs keep growing.

The company has committed to spending trillions of dollars on AI infrastructure. This includes building data centers around the world to run their AI models. These facilities need powerful computers, electricity, and constant maintenance.

According to HSBC Global Research, modeled OpenAI’s business and concluded that, given its current long-term cloud and data-center commitments, it faces a funding gap of roughly $207 billion that must be filled by 2030 through new equity, debt, or other financing.

Running ChatGPT and other AI models is expensive. Every time someone uses ChatGPT, it costs OpenAI money to process that request. These costs used to be covered by partnerships with companies like Microsoft, who provided cloud computing credits. Now, OpenAI is paying for most of these costs with actual cash because the usage has grown too large for credits alone.

OpenAI also faces growing pressures:

- Competition: Companies like Anthropic and Google are releasing new AI models regularly, forcing OpenAI to develop faster

- Developer tools: The company is building more tools and features for developers who want to use their AI technology

- Infrastructure needs: More users mean more servers, more storage, and higher operating costs

The bottom line is that OpenAI's expenses are growing faster than its income.

What Did Sam Altman Say About Going Public?

Sam Altman, OpenAI's CEO, shared honest thoughts about taking the company public during a recent interview on Alex Kantrowitz's YouTube channel. When asked about an IPO, he said, "I think it's fair to say it is the most likely path for us, given the capital needs that we'll have."

However, Altman has mixed feelings about this decision. He admitted he is 0% excited about becoming a public company CEO personally. The extra rules, reporting requirements, and public scrutiny don't appeal to him.

But he sees some benefits:

- Public markets would let regular investors share in OpenAI's growth

- The company needs access to large amounts of capital quickly

- OpenAI will soon hit shareholder limits that require going public anyway

Altman also mentioned that OpenAI would be going public "very late" compared to other tech companies. Most companies go public much earlier in their growth, but OpenAI has stayed private longer than usual.

Is OpenAI Planning an IPO Soon?

Yes, OpenAI is preparing to go public, though the exact timing remains unclear. The company's CFO, Sarah Friar, is working toward a 2027 stock market listing. However, some advisers think it could happen sooner, possibly in late 2026.

The company might file paperwork with financial regulators as early as the second half of 2026. This filing is the first official step toward becoming a public company.

Here's what the IPO could look like:

- The company could raise at least $60 billion, possibly much more

- OpenAI might be valued at $1 trillion when it goes public

- This would make it one of the largest IPOs in history

Interestingly, OpenAI officially says "An IPO is not our focus." The company claims it's concentrating on building its business and developing better AI. However, behind the scenes, preparations are clearly moving forward. The company needs massive amounts of money, and going public is the best way to get it.

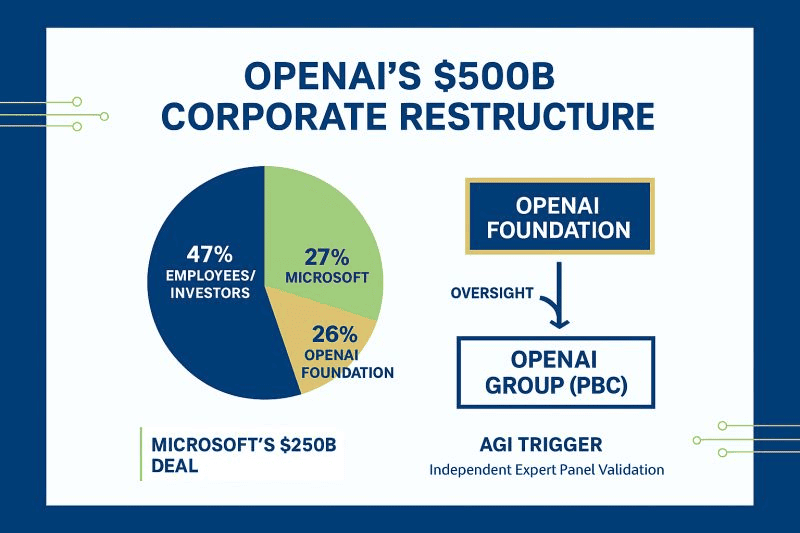

How Does This Connect to OpenAI's Recent Restructuring?

OpenAI just finished a major change to how the company is organized. This restructuring happened in October 2025 and took nearly a year of negotiations to complete. Understanding this change helps explain why the company can now raise $100 billion and plan an IPO.

OpenAI started as a nonprofit organization in 2015. The goal was to develop AI that benefits everyone, not just make money. But in 2019, the company realized it needed billions of dollars to build better AI models. Donations were not enough to cover these costs.

So OpenAI created a for-profit business arm while keeping the nonprofit in control. This setup worked but was complicated and made it hard to raise large amounts of money.

The new structure is much simpler:

- The nonprofit is now called the OpenAI Foundation

- The for-profit business is now called OpenAI Group PBC (Public Benefit Corporation)

- The Foundation owns 26% of the business, worth about $130 billion

- The Foundation still controls the entire company, even with only 26% ownership

- Microsoft owns 27% after investing $13.75 billion

This new setup removes limits on how much profit investors can make. Before, investors could only earn up to 100 times their investment. Now there is no cap. This makes OpenAI much more attractive to investors and prepares the company for going public.

Who Are OpenAI's Major Investors Right Now?

OpenAI's investor journey started in 2019 when Microsoft made its first $1 billion investment. This partnership grew significantly in January 2023 when Microsoft committed an additional $10 billion, bringing its total investment to around $13 billion. Today, Microsoft holds a 27% stake in OpenAI worth approximately $135 billion.

Thrive Capital entered the picture in early 2023 with about $130 million in initial investments. The firm later led an employee share tender worth $86 billion in early 2024. By October 2024, Thrive became a major player by leading a $6.6 billion funding round that valued OpenAI at $157 billion. In this round, Thrive invested over $1 billion and secured options for another $1 billion.

The October 2024 funding round brought in several major investors:

- SoftBank: $500 million

- Nvidia: $100 million

- Tiger Global Management: $350 million

- Altimeter Capital: $250 million

- Microsoft: Additional $750 million

The game changed completely in March 2025 when SoftBank led the largest private tech funding round in history. SoftBank committed $30 billion of the total $40 billion raised, valuing OpenAI at $300 billion. Microsoft, Thrive Capital, Coatue, and Altimeter contributed the remaining $10 billion.

Abu Dhabi's MGX joined during a secondary share sale in August 2025, where Thrive Capital, SoftBank, and Dragoneer purchased $6 billion worth of employee shares at a $500 billion valuation.

Currently, OpenAI holds over $64 billion in cash from these funding rounds. Amazon is now in talks for a potential $10 billion investment tied to using Amazon's Trainium AI chips, which would push OpenAI's valuation beyond $500 billion.

What Does This Mean for ChatGPT and OpenAI's Products?

The massive funding will directly improve ChatGPT and all OpenAI products. With $100 billion coming in, the company can build better AI models faster than before. OpenAI is racing against Google and Anthropic, so expect new features appearing more frequently.

What you can expect soon:

- Smarter AI models released every few months

- Better image and video generation capabilities

- Faster response times with fewer errors

- AI agents that handle complex tasks automatically

The money will build data centers worldwide, making ChatGPT faster and more reliable during busy times.

Here is something important coming:

OpenAI plans to show ads inside ChatGPT and add shopping recommendations. The company needs to make money directly from users, not just investors, and become profitable.

Running ChatGPT costs billions yearly, so expect features that either show advertisements or ask you to pay more for the same features. This helps cover the huge compute costs while building toward AGI (artificial general intelligence).

What Are the Risks and Challenges Ahead?

Despite bringing in $20 billion in revenue this year, OpenAI is losing money fast. The company expects to lose about $5 billion in 2025 alone. These mounting losses create serious pressure to become profitable soon.

The AI market is also cooling down. Investors are starting to question whether the massive spending on AI technology will actually pay off. Many worry that companies are investing too much money too quickly without seeing real returns.

Major challenges OpenAI faces:

- Global chip shortage limiting access to necessary hardware

- Growing competition from Google, Anthropic, and smaller startups

- Need to balance rapid growth with actually making profit

- Uncertain IPO market conditions that could delay going public

Investors who put billions into OpenAI want to see returns on their money. This creates pressure to launch revenue-generating features quickly, even if they might upset users. The upcoming ads and shopping features are examples of this pressure.

If OpenAI goes public, the company will face even more scrutiny. Public companies must report financial details every quarter and answer to shareholders. Every decision will be questioned, and any losses will be visible to everyone. This adds another layer of complexity to an already challenging situation.

What's Happening in the Broader AI Market?

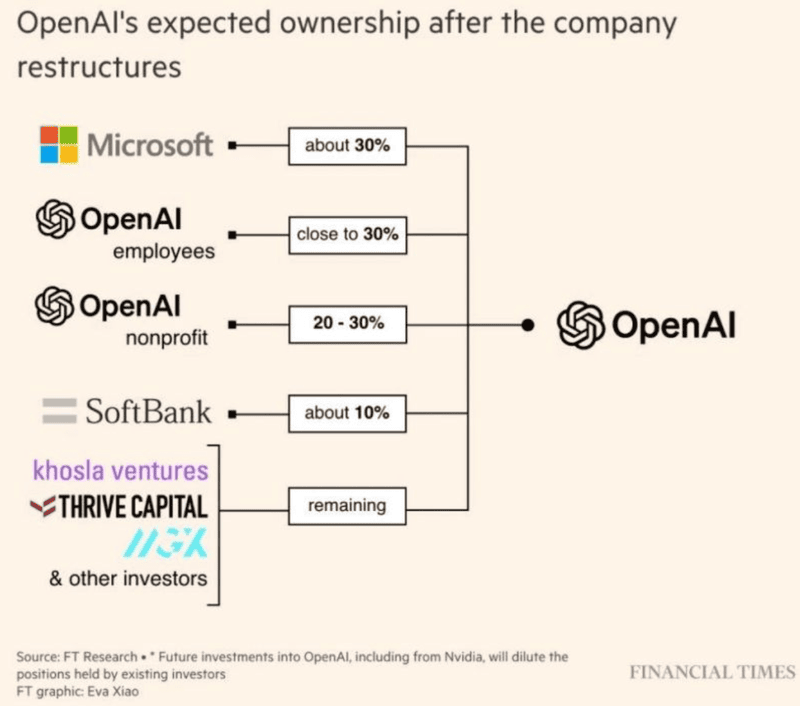

The AI industry is experiencing both massive growth and growing concerns at the same time. Nvidia made history in October 2025 by becoming the first company ever to reach a $5 trillion market value. This milestone shows how much money is flowing into AI market. The company currently sits at around $4.6 trillion as of December 2025.

CoreWeave, an AI cloud company, went public in March 2025 at a $23 billion valuation. However, the IPO showed early warning signs. The company had to cut its expected fundraising from $4 billion down to $1.5 billion because investors were becoming more careful. Despite this rocky start, CoreWeave's stock has since tripled from its IPO price, proving there is still strong demand for AI infrastructure.

Competition is heating up across the industry:

- Google's Gemini models are challenging ChatGPT directly

- Anthropic's Claude has gained significant market share

- Smaller startups are launching cheaper AI alternatives

- No single company dominates the AI race anymore

However, serious problems are appearing. A severe shortage of memory chips, especially high-bandwidth memory needed for AI, is affecting the entire tech sector. Prices for some memory chips have doubled since February 2025. Experts say this shortage will continue through late 2027, delaying hundreds of billions in planned AI investments.

Market sentiment has cooled significantly since November 2025. Nvidia's stock dropped over 12% that month despite strong sales. Investors are questioning whether companies are spending too much money on AI without seeing real profits. Many worry that AI companies are taking on too much debt to fund their growth.

The concern is simple: companies like Amazon, Microsoft, and Oracle are projected to spend $600 billion on AI infrastructure by 2027, but nobody knows if this spending will actually generate enough revenue to justify the cost.

Comments

Your comment has been submitted