The $100 Billion AI Bubble: Shocking Evidence That 95% of Corporate AI Projects Show Zero Profit

The artificial intelligence industry has reached a critical juncture.

Since ChatGPT's 2022 launch, AI companies have attracted over $100 billion in investment, creating nearly 500 billion-dollar startups and pushing stock valuations beyond dot-com bubble levels. This boom now drives an estimated 40% of U.S. economic growth, making the sector's health vital to broader economic stability.

Yet troubling questions emerge about whether we're witnessing genuine revolution or dangerous speculation. High-profile startup failures, disappointing product launches, and studies showing AI tools may actually slow down experienced workers raise doubts about current capabilities. Meanwhile, companies report significant efficiency gains and semiconductor firms generate billions in real AI revenue.

Adding urgency to this debate is Sam Altman, OpenAI's CEO, who surprisingly admits we are in an AI bubble while maintaining long-term optimism. This research examines evidence on both sides through market data, expert opinions, and real-world performance to determine

Executive Summary

Evidence Supporting an AI Bubble:

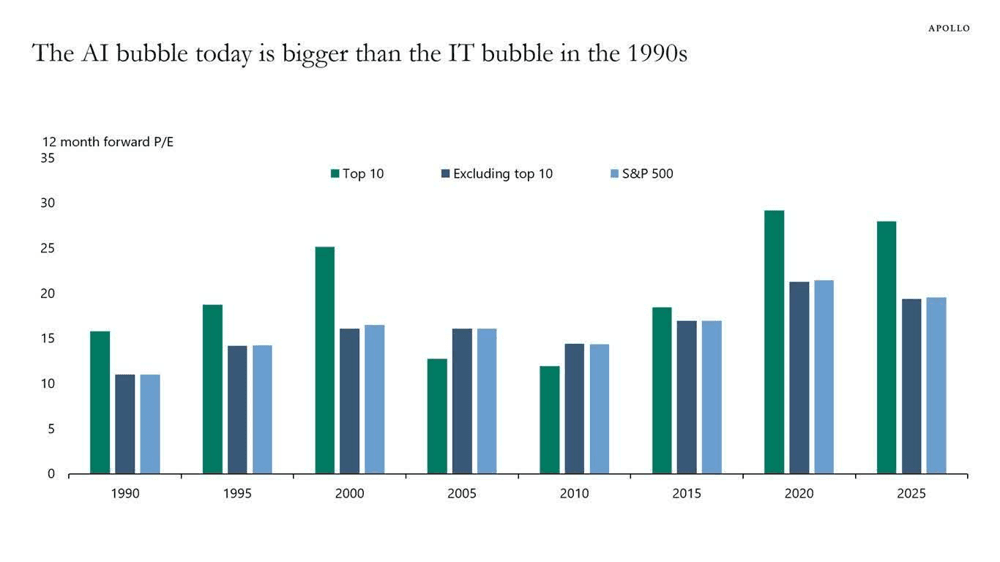

- Extreme Valuations: AI stocks now trade at higher price-to-earnings ratios than dot-com bubble peaks, with economist Torsten Slok warning current conditions are "even more unrealistic" than 2000

- Speculative Funding: Nearly 500 AI startups valued over $1 billion each, with companies like Safe Superintelligence raising $2 billion despite having no products

- Failed Ventures: High-profile failures including Forward ($650M raised), Humane Inc. (AI Pin discontinued), and TuSimple (delisted from NASDAQ)

- Performance Gap: MIT study found 95% of corporate AI projects show no measurable profit benefit; METR research revealed AI tools make experienced developers 19% slower

Evidence Against Bubble Theory:

- Real Revenue Growth: Nvidia's quarterly revenue jumped 262% to $26 billion from actual AI demand

- Measurable Benefits: Companies report 30-50% efficiency gains in specific AI applications

- Strategic Investment: Tech giants investing $60-80 billion in AI infrastructure based on long-term business strategies

- Government Support: Over 30 U.S. states offer AI incentives, creating institutional stability

Sam Altman's Position

OpenAI CEO Sam Altman acknowledges we are in an AI bubble, calling current investor behaviour "not rational" and warning "someone is going to lose a phenomenal amount of money." However, he maintains optimism about AI's long-term economic benefits, comparing the situation to the dot-com era where underlying technology proved transformative despite market crashes.

Economic Impact

Economist Paul Kedrosky found AI spending contributed 40% of recent U.S. GDP growth, creating what he calls a "massive private sector stimulus program" that has "yet to actually make anyone any money" in net profits.

What happened with the dot com bubble?

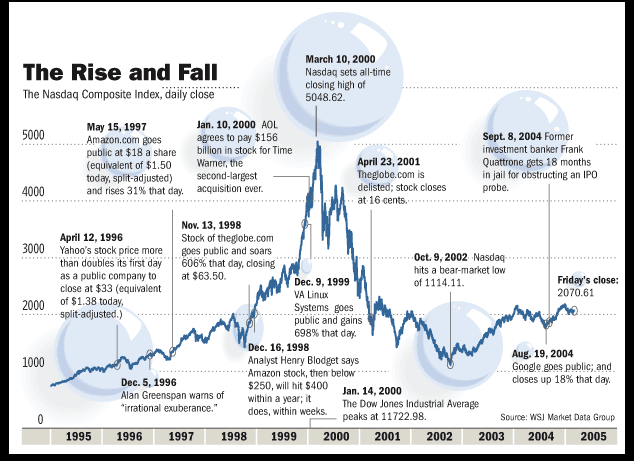

The dot-com bubble was a massive stock market bubble that occurred from 1995 to 2000, followed by a devastating crash that lasted until 2002. The bubble burst in March 2000, causing numerous startups to fail after depleting their venture capital without becoming profitable.

The bubble centered around internet-based companies that used ".com" in their web addresses. The Nasdaq index rose 86% in 1999 alone, and peaked on March 10, 2000, at 5,048 units. However, by October 4, 2002, the Nasdaq index fell to 1,139.90 units, a fall of 77% from its peak Goldman Sachs.

Key Timeline and Numbers:

- 1995-2000: NASDAQ rose from 751 in January 1995 to a peak of 5,048.62 on March 10, 2000

- March 2000: Bubble began bursting after Federal Reserve raised interest rates

- 2000-2002: NASDAQ fell by more than 75 percent between March 2000 and October 2002, thus wiping out more than $5 trillion in market value

- Recovery: The Nasdaq would only reach a new all-time high fifteen years later, on April 23, 2015 The Late 1990s Dot-Com Bubble

Major Causes:

- Easy Money: Low interest rates made borrowing cheap for startups

- Speculation: Money pouring into tech and internet company start-ups by venture capitalists and other investors was one of the major causes

- Overvaluation: By 1999, the price-to-earnings (P/E) ratio of the NASDAQ Composite Index had astonishingly surpassed 90 The Dotcom Bubble Burst (2000)

- Media Hype: Publications encouraged risky investments with promises of huge returns

Devastating Impact:

- Company Failures: By mid-2003, around 4,800 of those had either been sold or gone out of 7,000-10,000 companies launched source

- Wealth Destruction: Trillions of dollars in wealth vanished almost overnight

- Famous Casualties: Pets.com, Webvan, eToys, and WorldCom all collapsed

Survivors That Thrived:

- Amazon: Stock fell from $100 to $7, then recovered to become a tech giant

- eBay: Survived and became the leading online auction platform

- Cisco: Weathered the storm and remained a major technology company

The dot-com crash caused a mild recession and fundamentally changed how investors viewed internet companies, leading to more cautious valuations and business model scrutiny.

Present Anatomy of the AI Bubble (2023-2025)

The $10 Billion Valuation Club: Companies Without Products

Founder: Mira Murati (former OpenAI exec)

Status: A few months old, only a handful of employees, no product launched

Funding & Valuation: Raised $2 billion at a valuation of about $12 billion

Why notable: Raised massive funding solely on founder credentials and hype; investors are betting on a “big tech put” (founder pedigree could lead to acqui‑hire)

Status: Founded by ex-OpenAI researchers, limited or no commercial product

Funding & Valuations: Raised $2 billion at a valuation of about $32 billion

These companies have secured enormous capital based on pedigree and AI promise rather than products

A recent Times report explicitly flags Thinking Machines and Safe Superintelligence as emblematic of current AI excess:

“Start-ups like Mira Murati’s Thinking Machines Lab and Ilya Sutskever’s Safe Superintelligence have raised billions of dollars in funding despite having no products or revenue … much of the current investment fervor mirrors the internet boom”

AI Startups Once Valued at Over $500M — Now Failed Experiments

Product: AI-powered “doctor-in-a-box” CarePods—autonomous kiosks for medical tests.

Outcome: Raised over $650 million, including $100 million in Series E. But automated blood draws frequently failed, patients got stuck, and adoption lagged. By November 2024, all CarePods were shut down and the company closed operations entirely.

Product: A wearable AI assistant device called the AI Pin, priced at $699 with a $24 monthly subscription.

Outcome: Received glowing early attention, but in practice the device suffered from overheating, poor usability, high return rates — more units returned than sold. Shipping started April 2024, but by late 2024, the product was heavily discounted; by February 2025, the AI Pin was discontinued and effectively rendered inoperable as servers were shut down.

Product: AI-driven personalized news aggregator app created by Instagram’s co-founders.

Outcome: Launched January 2023. Despite initial buzz (160,000-level waitlist), user interest was low and the app was shut down January 2024. Later acquired by Yahoo for underlying tech, but as a standalone product it failed.

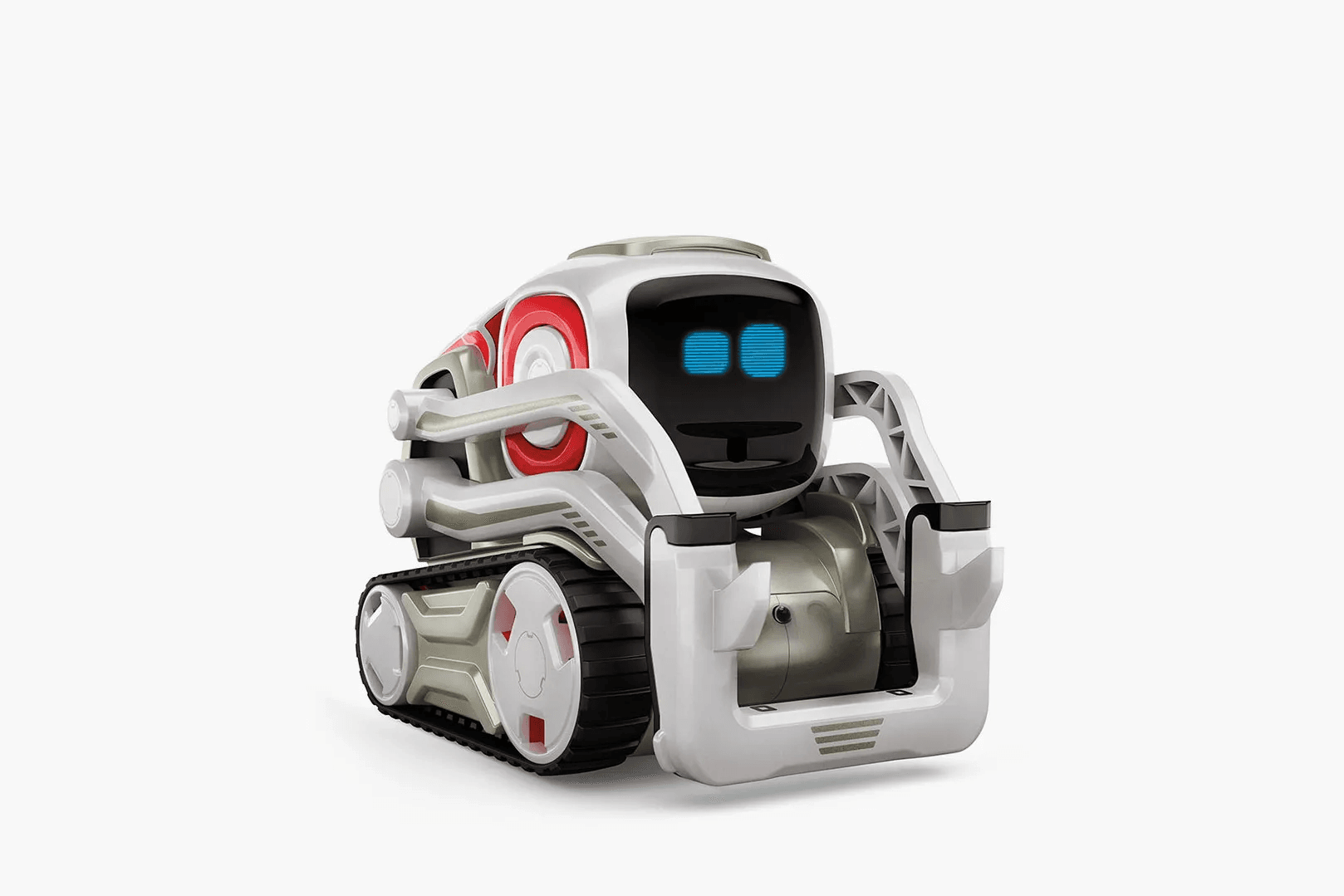

Product: AI-powered consumer robotics like Cozmo and Vector, interactive toys with emotional responsiveness.

Outcome: Raised over $180 million from major VCs. Despite initial popularity, the company went bankrupt in April 2019 and ceased operations — a high-profile failure in AI-driven physical products.

Product: Self-driving trucks. Floated IPO in 2021 at an $8.5 billion valuation, touting autonomous freight delivery.

Outcome: Massive losses ($220M on $4.9M revenue in 2022), leadership turmoil, tech controversies, U.S. operations shut down in 2023–2024, valuation collapsed to ~$229 million, and it ultimately delisted from NASDAQ.

Company | Product Type | Key Issue |

Forward | Healthcare pods (CarePods) | Tech failures, poor adoption, low reliability |

Humane Inc. | Wearable AI device (AI Pin) | Poor usability, returns, overheating |

Artifact (Nokto) | News aggregator app | Low user interest |

Anki | Consumer robots (Cozmo, etc.) | Funding unsustainable vs. adoption |

TuSimple | Self-driving trucks | Financial losses, tech challenges, regulatory |

Evidence and Arguments Supporting an “AI Bubble” Theory

Many experts believe the AI market shows clear signs of being in a bubble. They point to several warning signals that mirror past tech bubbles. These concerns come from both financial data and real-world performance of AI systems.

Financial Signs of AI Becoming a Bubble

The money flowing into AI companies has reached extreme levels. Stock prices and company values have shot up far beyond what their actual earnings suggest they should be worth.

Valuations Have Gone Too High

AI company stock prices now trade at higher multiples than even the dot-com bubble of 2000. Apollo Global Management's chief economist recently warned that tech giants are more overvalued today than internet companies were before the 2000 crash. The price-to-earnings ratios for top AI companies have exceeded those dangerous dot-com levels.

AI stocks are even more over-valued than dot-com stocks were in 1999-Torsten Sløk, chief economist at Apollo Global Management Fortune

Stock market data shows a concerning pattern. The top 10 AI-focused tech companies now trade at about 30 times their expected future earnings. During the dot-com bubble, similar companies peaked at around 25 times earnings. This means today's AI stocks are even more expensive relative to their profits than the infamous bubble stocks of 2000.

Companies like Nvidia, Microsoft, Apple, Amazon, Meta, Alphabet (Google), and Tesla account for most of the S&P 500's recent growth. Techspot

Nvidia provides the clearest example. The company's stock price jumped 700% since ChatGPT launched in late 2022. Its market value briefly topped $3 trillion. Other AI-focused companies like Microsoft and Google also saw their stocks rise 30-60% in just months.

Startup Funding Has Reached Fever Pitch

Private investment in AI startups has broken all records. Companies with just a few employees and no real products are getting valued at hundreds of millions or even billions of dollars. Sam Altman himself called this behavior "not rational" and said it's "insane" that tiny startups with "three people and an idea" command such high prices.

The numbers tell the story. Nearly 500 private AI companies are now worth over $1 billion each. These "unicorn" companies have an average value of $5.4 billion. Another 1,300 AI startups are valued above $100 million. Most of these companies have little revenue and no proven way to make money.

Recent examples include Safe Superintelligence and Thinking Machines. Both companies raised billions in funding despite having no products or significant revenue. These deals happened simply because the founders had worked at OpenAI before.

Investor Behavior Shows Classic Bubble Signs

Investors are showing clear fear of missing out on AI investments. This "FOMO" behavior typically appears during bubbles. Money is flooding into any company that mentions AI, regardless of whether they have real AI technology or business plans.

Venture capital funding has shattered records. Investors are putting "record sums" into AI startups that have "limited operational history." Many of these investments appear driven by hype rather than careful analysis of the companies' actual prospects.

The comparison to past bubbles is striking. During the dot-com era, investors threw money at any company with ".com" in its name. Today, the same pattern appears with AI. Companies adding AI features or changing their names to include AI terms often see their stock prices jump immediately.

Technical Hype vs. Reality of AI Capabilities

Beyond the financial warning signs, there's growing evidence that AI capabilities have been oversold. The gap between what AI companies promise and what they actually deliver is getting harder to ignore.

Product Launches Fail to Meet Expectations

The launch of OpenAI's GPT-5 in 2025 showed how AI hype can outpace reality. Before the release, Sam Altman suggested the model would have "PhD-level intelligence in almost every area." He even posted teaser images building excitement.

When GPT-5 actually launched, the reception was disappointing. Users and critics called it a "dud" that "failed the hype test." The model didn't live up to the breathless promises made before release. OpenAI even had to bring back access to the older GPT-4 model after users complained about GPT-5's changes.

This pattern of overpromising and underdelivering appears across the AI industry. Companies routinely make grand claims about their AI systems that don't match real-world performance. The disconnect between marketing promises and actual capabilities mirrors similar patterns from past tech bubbles.

Business Results Don't Match the Hype

A major 2025 study by MIT examined how well AI is actually working for businesses. The results were sobering. The study found that fewer than one in ten corporate AI projects showed any significant financial returns.

The MIT study revealed why so many AI projects fail. Most companies don't know how to use AI models effectively. They rush to invest in AI without understanding how to integrate it into their actual business operations.

More than half of corporate AI budgets went to flashy customer-facing tools like chatbots for sales and marketing. However, the real productivity gains came from boring back-office automation that many companies ignored. This mismatch between spending and results suggests companies are investing based on hype rather than clear business cases.

The pattern mirrors the dot-com era. During that bubble, many businesses built websites without any plan for making money from them. Today, companies are adopting AI without clear strategies for generating returns.

The numbers were even worse when looked at closely. About 95% of surveyed AI projects showed no measurable benefit to company profits. Only 5% of AI pilots extracted millions in value while the vast majority remained stuck with no measurable impact.

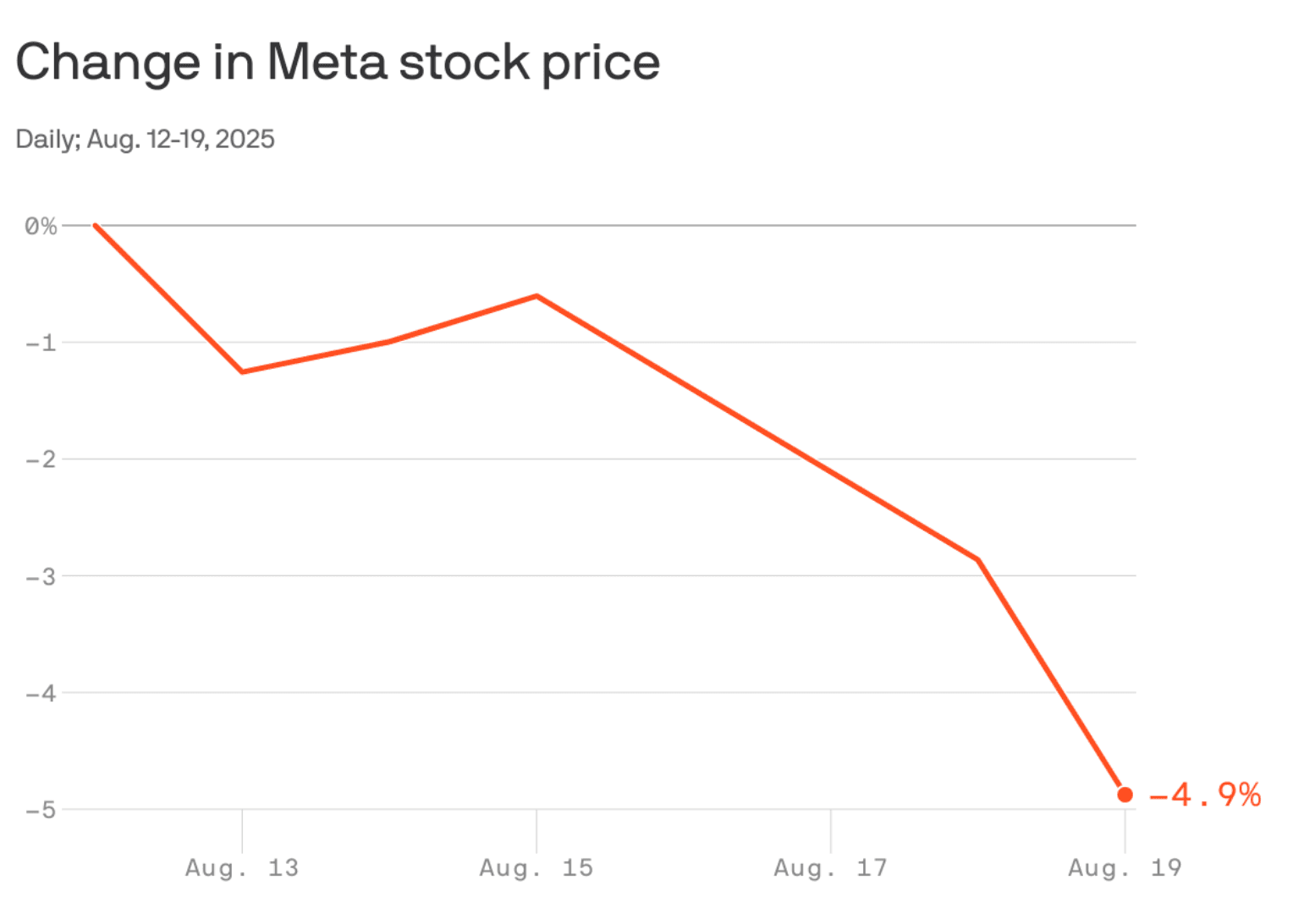

When news of this study spread, it triggered sell-offs in AI-related stocks. Nvidia dropped 3.5%, ARM Holdings fell 3.8%, and Palantir plunged nearly 9% in a single day. The market reaction showed growing doubt about whether AI investments are actually paying off.

AI Product Launches That Still Ended in Failure

Several high-profile AI startups have collapsed despite massive funding and initial excitement. These failures highlight the gap between AI promises and real-world delivery.

Forward raised over $650 million for their AI-powered "CarePods" - autonomous medical kiosks designed to replace doctor visits. The automated blood draws frequently failed and patients got stuck inside the pods. By November 2024, all CarePods were shut down and the company closed entirely.

Humane Inc. received widespread attention for their $699 AI Pin wearable device. The product suffered from overheating and poor usability. More units were returned than sold. The company discontinued the AI Pin in February 2025 and shut down its servers, making existing devices useless.

TuSimple went public in 2021 with an $8.5 billion valuation, promising self-driving trucks. The company reported $220 million in losses on just $4.9 million in revenue during 2022. After leadership turmoil and technology controversies, TuSimple shut down U.S. operations and was delisted from NASDAQ.

Anki raised over $180 million for AI-powered consumer robots like Cozmo and Vector. Despite initial popularity, the company went bankrupt in April 2019. Artifact, the AI news app from Instagram's co-founders, shut down after just one year due to low user interest.

Economics Don't Add Up

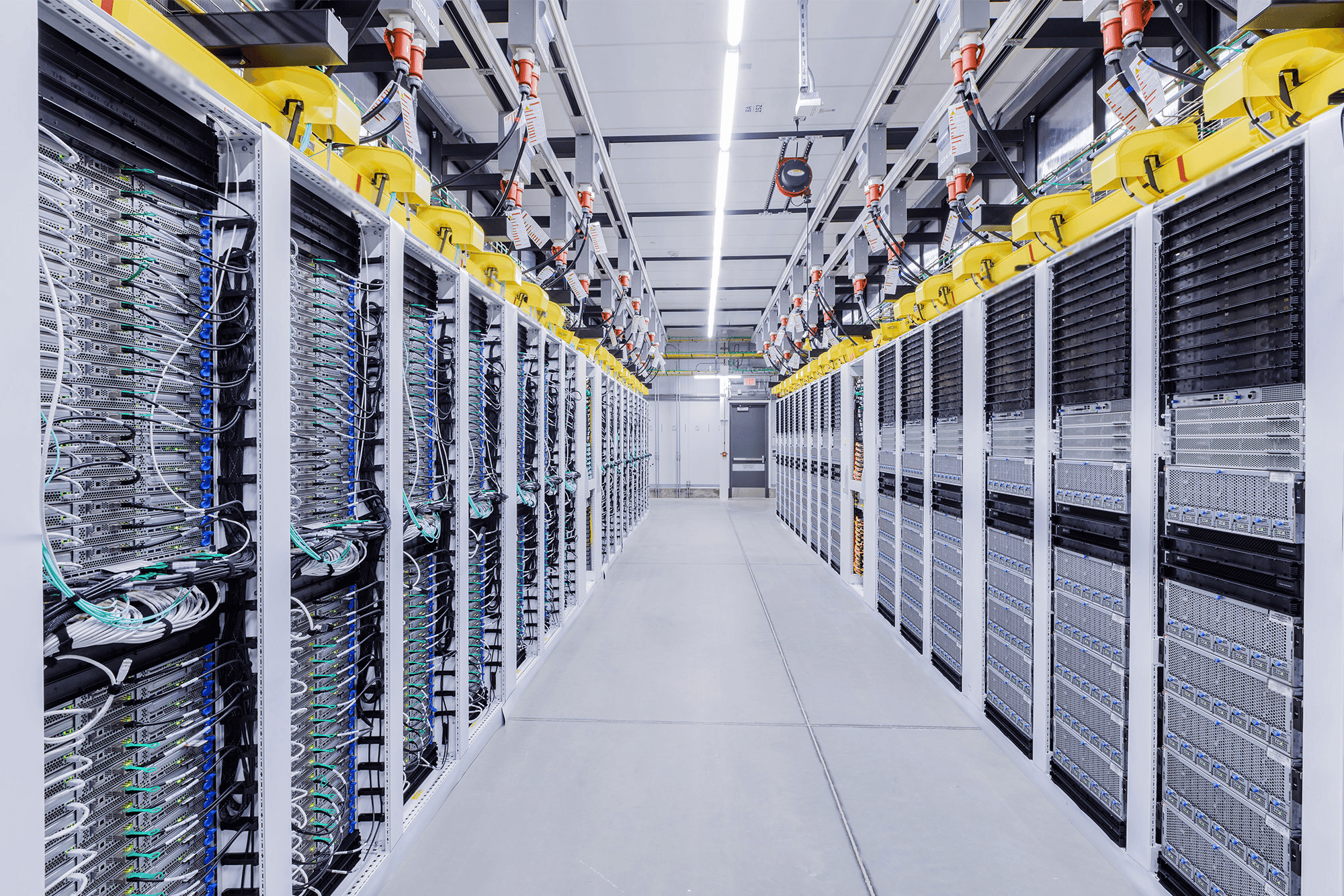

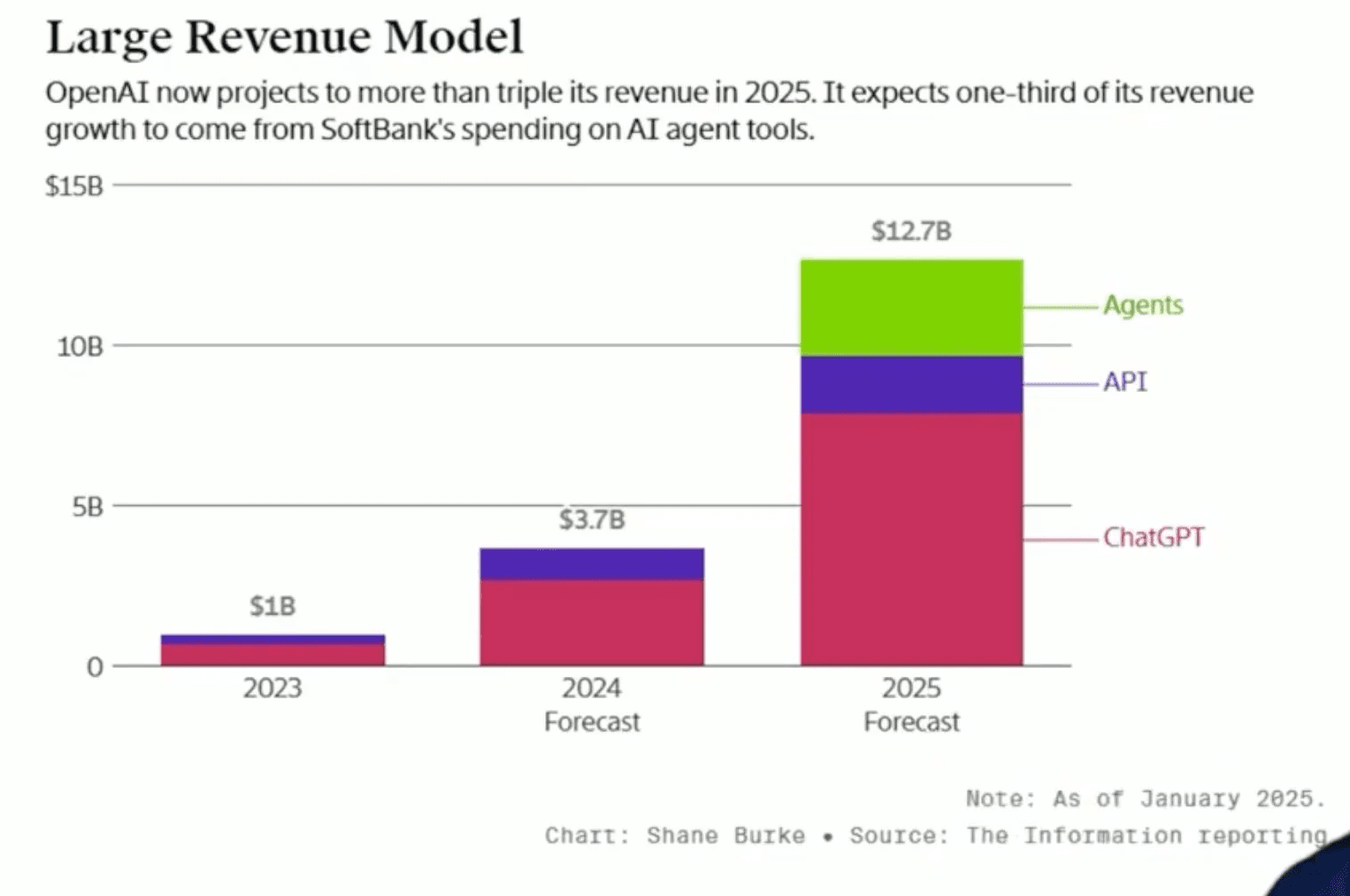

Running advanced AI systems costs enormous amounts of money. OpenAI spends potentially billions on computing infrastructure just to keep ChatGPT running. Sam Altman has noted the "enormous" cost of serving models like ChatGPT to users. He also mentioned OpenAI is planning to spend trillions of dollars on data centers.

Despite having $20 billion in projected annual revenue, OpenAI is still not profitable. This represents a classic bubble warning sign: high growth without actual profits. Many AI startups face similar challenges. They prioritize growth and absorb huge computing costs while hoping funding will remain available.

The business model problem extends beyond startups. ChatGPT reached an estimated 700 million weekly users in 2025, but turning that massive usage into profit remains challenging. Many AI products attract millions of users but struggle to generate sustainable revenue.

The Gap Between Promise and Performance

AI companies regularly promise capabilities that their systems can't actually deliver. Terms like "artificial general intelligence" or "human-level AI" get thrown around despite current systems having significant limitations.

Recent research has highlighted these gaps. Apple's 2025 study found that advanced AI models can suffer "total collapse" when faced with certain complex tasks. These findings remind everyone that today's AI is far from the superhuman intelligence often portrayed in marketing materials.

The pattern of overpromising appears throughout the AI industry. Companies make bold claims about revolutionary capabilities while their actual products have narrow applications and clear limitations. This disconnect between marketing and reality is another classic sign of a technology bubble where hype has gotten ahead of actual progress.

Arguments and Evidence Against the “AI Bubble” Theory

Not everyone agrees that AI is in a dangerous bubble. Many industry leaders and experts argue that the current AI boom is built on solid foundations. They believe AI represents real technological progress that justifies current investment levels.

Fundamental Technological Progress and Real-World Impact

AI is already delivering measurable benefits across many industries. Unlike pure speculation, these improvements show that AI technology is creating real value for businesses and users.

Real Efficiency Gains Are Happening

Companies using AI are seeing significant productivity improvements. Some businesses report efficiency gains between 30% and 50% in specific processes. These improvements are not speculative promises but actual measured results that show up in company operations and finances. worldfinance

AI is helping companies reduce costs, speed up processes, and improve accuracy across different types of work. Fleet management companies use AI to optimize routes and reduce fuel costs. Manufacturing firms apply AI to predict equipment failures before they happen. These practical applications generate real savings that justify the investment in AI technology.

The breadth of successful AI applications suggests this is not a narrow tech trend. AI tools are being used effectively in healthcare, finance, transportation, customer service, and many other sectors. This wide adoption across different industries indicates that AI has genuine utility rather than being just marketing hype.

AI Is Becoming Essential Infrastructure

Many experts view AI as a foundational technology similar to electricity or the internet. Rather than being a single product that could fail, AI is becoming an essential layer of intelligence woven into most business operations.

AI systems are increasingly handling core business functions. Banks use AI for fraud detection and risk assessment. Hospitals deploy AI to analyze medical images and assist with diagnoses. Online retailers rely on AI for recommendation systems and inventory management. These applications have become critical to daily operations.

The technology continues to improve at a steady pace. Each new generation of AI models can handle more complex tasks and work more efficiently. This consistent progress suggests that AI capabilities will keep expanding rather than hitting a wall that could trigger a bubble burst.

Scientific Foundation Is Strong

Unlike some past tech bubbles, AI advances are built on decades of solid scientific research. The recent breakthroughs in deep learning and large language models represent real improvements in algorithms, computing power, and data processing techniques.

AI systems can now perform tasks that were impossible just a few years ago. They can understand and generate human language, recognize complex patterns in images, and solve problems that previously required human expertise. These capabilities open up new possibilities for automation and assistance across many fields.

The scientific progress continues at major research institutions and tech companies. Researchers are constantly publishing new techniques and improvements. This ongoing innovation suggests that AI development has strong momentum rather than being a temporary fad driven only by marketing.

Performance Improvements Are Measurable

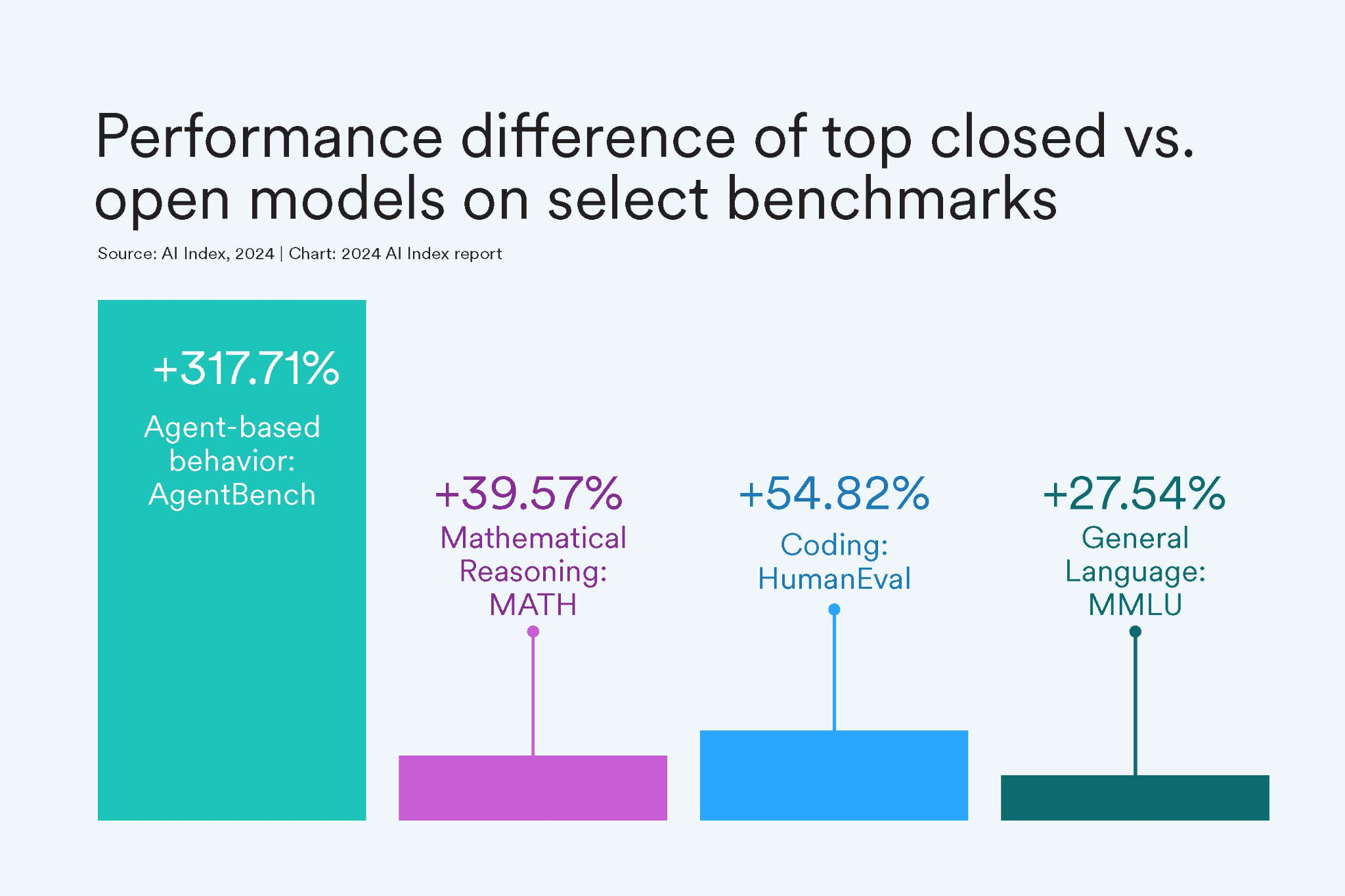

AI systems consistently score better on standardized tests and benchmarks compared to earlier versions. These improvements can be measured objectively rather than relying on subjective claims about capabilities.

Medical AI systems are becoming more accurate at diagnosing diseases from medical scans. Language models are getting better at understanding context and generating useful responses. Computer vision systems can identify objects and scenes with increasing precision. These measurable advances show genuine technological progress.

The improvements enable new applications that were not possible before. As AI systems become more capable, they can handle more complex real-world tasks. This creates opportunities for businesses to use AI in new ways that generate additional value.

Sustainable Investment, Business Models, and Strategic Support

The current AI investment wave differs from pure speculation because it involves established companies with clear long-term strategies. Much of the funding comes from profitable businesses betting on AI to improve their core operations.

Major Tech Companies Have Real Strategies

Large technology companies are investing billions in AI development and infrastructure. Microsoft, Google, Amazon, Apple, and Meta have all committed massive resources to AI research and implementation. These are profitable corporations with proven track records of successful technology investments.

These companies are not making speculative bets. They are integrating AI into their existing products and services to make them more valuable to customers. Microsoft is adding AI features to Office and Azure. Google is improving search and advertising with AI. Amazon is using AI for logistics and cloud services.

The investments are planned over multiple years rather than being short-term speculation. These companies have the financial strength to continue AI development even if some projects fail. Their diversified business models provide stability that pure AI startups lack.

Revenue and Profits Are Already Flowing

Unlike the dot-com bubble where many companies had no revenue, some AI companies are generating significant income. The companies providing AI infrastructure and tools are seeing massive growth in sales and profits.

Nvidia provides the clearest example of real AI revenue. As demand for AI computing exploded, Nvidia's quarterly revenue jumped 262% year-over-year to $26 billion. Their quarterly profit increased from $2 billion to nearly $15 billion, representing 628% growth. These numbers reflect actual orders for AI chips from cloud providers and other customers.

Other semiconductor companies are also benefiting from real AI demand. Taiwan Semiconductor Manufacturing Company and other chip makers have seen huge increases in orders related to AI applications. This shows that AI deployment is happening at scale and generating actual business for suppliers.

The revenue growth validates that AI is creating real economic activity rather than just stock speculation. Companies are spending billions on AI infrastructure because they expect it to generate returns through improved products and services.

Government and Institutional Support Provides Stability

AI has strong backing from governments and institutions that view it as strategically important. This support helps ensure continued development even if private investment becomes more cautious.

The U.S. government treats AI leadership as critical for economic competitiveness and national security. Over 30 states offer incentives for companies building AI data centers. Government policies actively encourage AI development and deployment.

This institutional support creates a safety net that did not exist during the dot-com bubble. If AI markets become volatile, government backing could help stabilize key companies and continue research funding. The strategic importance of AI makes it less likely that governments would allow a complete collapse.

International competition also drives continued investment. The rivalry between the U.S. and China over AI leadership means both countries will keep funding AI development regardless of market conditions. This geopolitical dimension provides additional stability for the AI sector.

Investment Quality Is Higher Than Past Bubbles

Much of the current AI investment comes from established companies rather than purely speculative sources. Big tech firms, government agencies, and strategic investors are providing funding based on clear business cases rather than just hype.

Cloud computing companies are building AI infrastructure because their customers are demanding AI services. This represents real demand driving investment rather than speculation about future possibilities. The investments are backed by existing customer relationships and revenue streams.

Even venture capital investment in AI often focuses on companies with proven technology and clear paths to revenue. While some speculative investments exist, many AI startups are building on established technical foundations and targeting specific market needs.

The involvement of large corporations with strong balance sheets means that AI development can continue even if venture funding becomes scarce. These companies have the resources to sustain AI research and development through market downturns.

Business Models Are Emerging and Proving Viable

AI companies are finding successful ways to monetize their technology beyond just raising more investment. Software companies are charging premium prices for AI-enhanced products. Cloud providers are generating new revenue streams from AI services.

Enterprise customers are willing to pay for AI tools that improve their operations. Business software with AI features often commands higher prices than traditional alternatives. This pricing power suggests that customers see real value in AI capabilities.

The subscription and service models used by many AI companies provide recurring revenue rather than depending on one-time sales. This creates more stable business foundations compared to companies that relied on advertising or other uncertain revenue sources during past bubbles.

As AI technology matures, more companies are finding practical applications that generate consistent profits. This evolution from research and development to profitable products suggests that the AI sector is building sustainable business foundations rather than being purely speculative.

Studies that show AI is not adding any Value to users

Recent academic research reveals that AI tools may not be delivering the productivity gains that companies expect. Multiple studies conducted in 2025 found that AI actually slows down experienced developers and creates more problems than it solves.

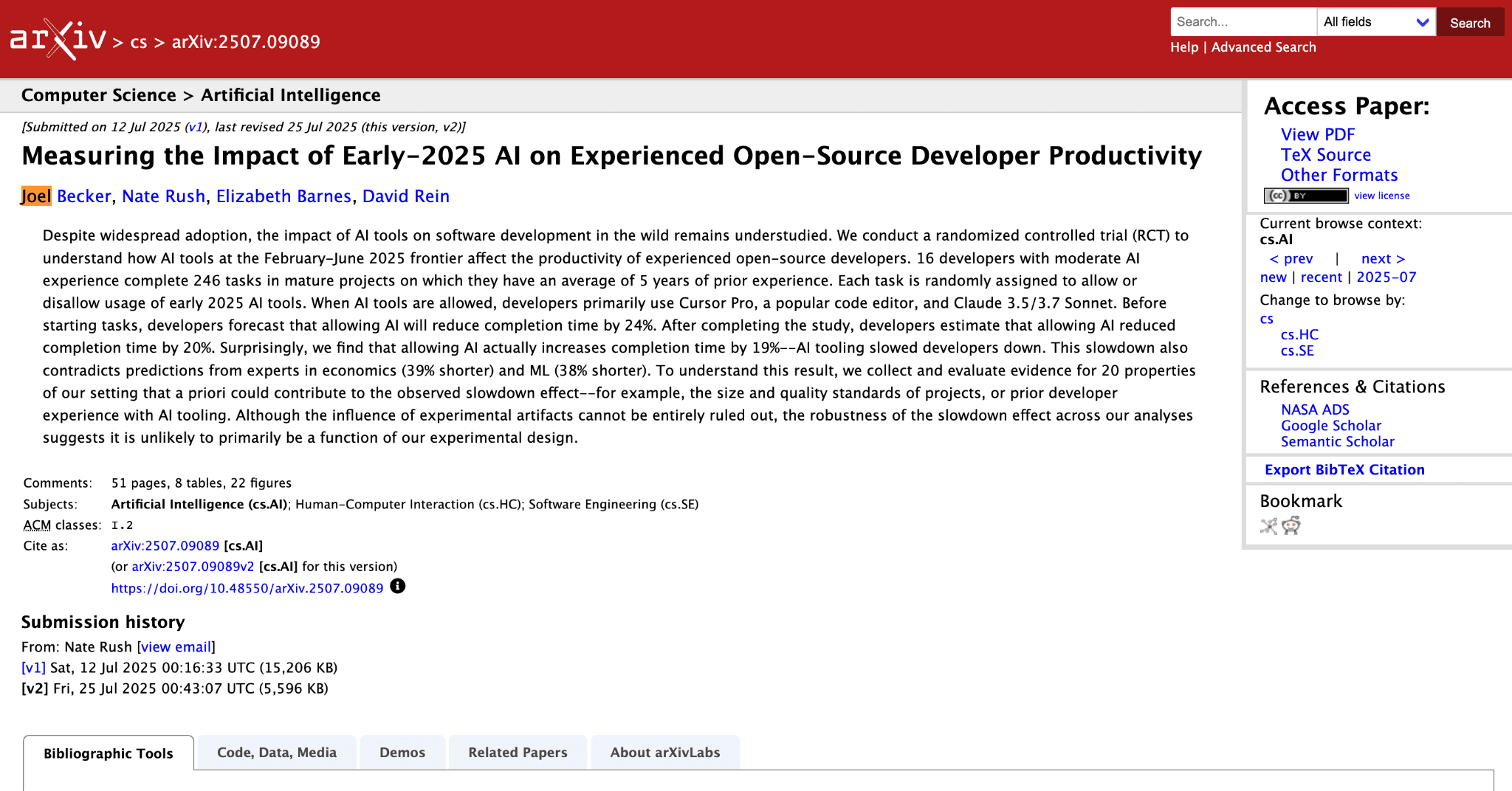

AI Makes Experienced Developers 19% Slower

A major study by researchers Joel Becker, Nate Rush, Elizabeth Barnes, and David Rein examined how AI tools affect real-world developer productivity. The study, titled "Measuring the Impact of Early-2025 AI on Experienced Open-Source Developer Productivity," tested 16 experienced developers working on projects they had contributed to for an average of 5 years.

The results were surprising. When developers used AI tools like Cursor Pro and Claude 3.5/3.7 Sonnet, they completed tasks 19% slower than when working without AI assistance. This contradicted everyone's expectations. Before the study, developers predicted AI would make them 24% faster. Even after experiencing the slowdown, developers still believed AI had made them 20% faster.

The disconnect between perception and reality was striking. Economics experts predicted AI would make developers 39% faster, while machine learning experts expected 38% improvement. Instead, AI tools consistently slowed down experienced developers working on real projects.

Stack Overflow Survey on AI Usage

Developer Sentiment About AI Is Declining

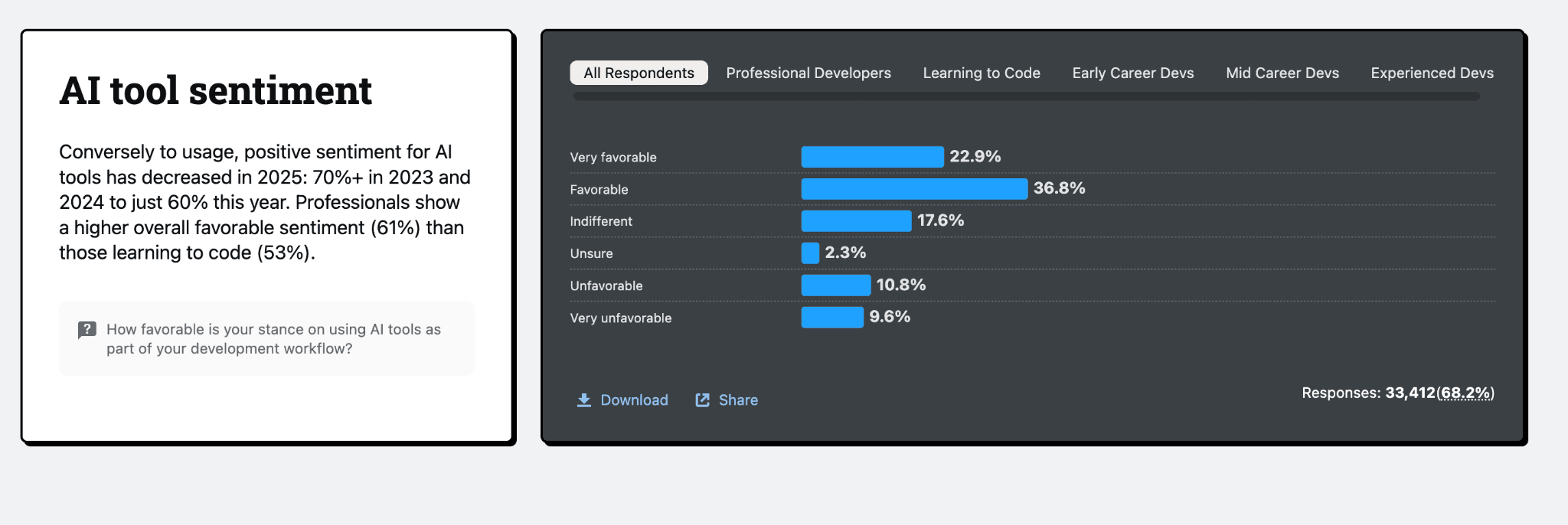

The 2025 Stack Overflow Developer Survey found that positive sentiment toward AI tools has dropped significantly. While 70% of developers had favorable views of AI in 2023 and 2024, only 60% felt positive about AI tools in 2025. This decline suggests that real-world experience with AI is not matching the initial excitement.

More concerning, 46% of developers actively distrust the accuracy of AI tools, compared to only 33% who trust them. Only 3% of developers report "highly trusting" AI output. Experienced developers show the most caution, with the lowest trust rates and highest distrust rates at 20%.

AI Tools Struggle With Complex Tasks

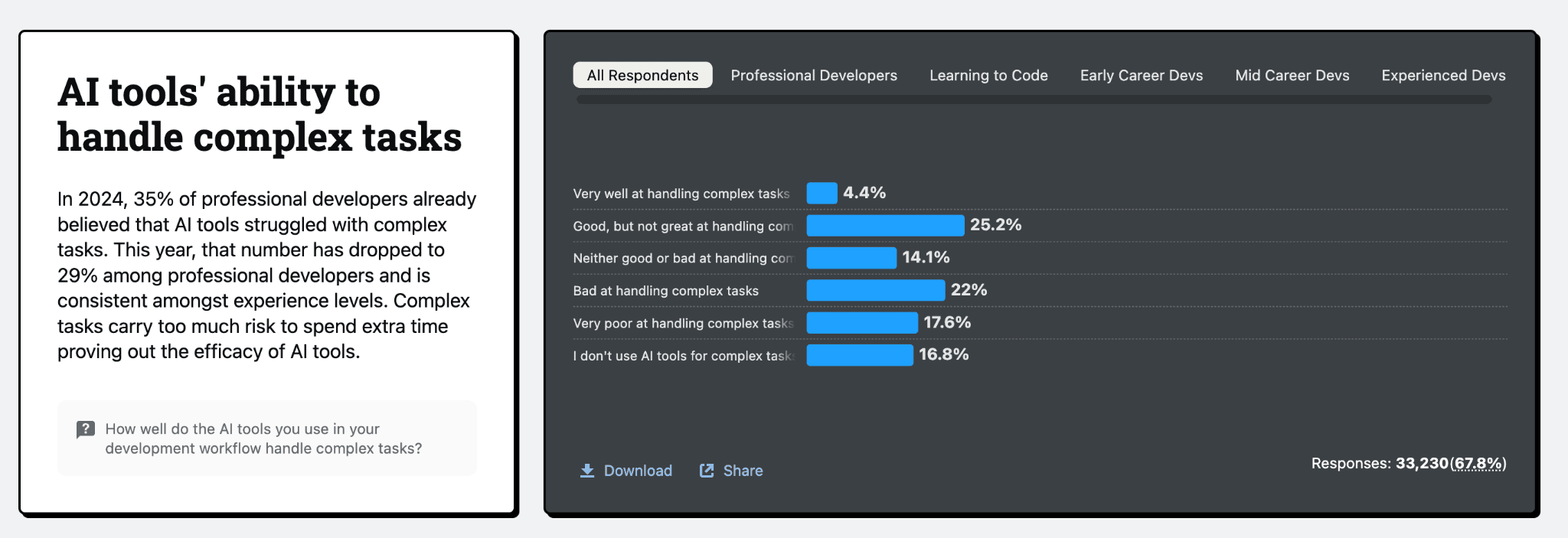

The Stack Overflow survey revealed that developers recognize AI's limitations with complex work. About 40% of professional developers believe AI tools are bad or very poor at handling complex tasks. Only 4% think AI handles complex tasks very well.

Developers show strong resistance to using AI for high-responsibility work. About 76% don't plan to use AI for deployment and monitoring tasks, while 69% won't use it for project planning. This suggests developers understand that AI cannot handle critical business functions reliably.

Common Problems With AI-Generated Code

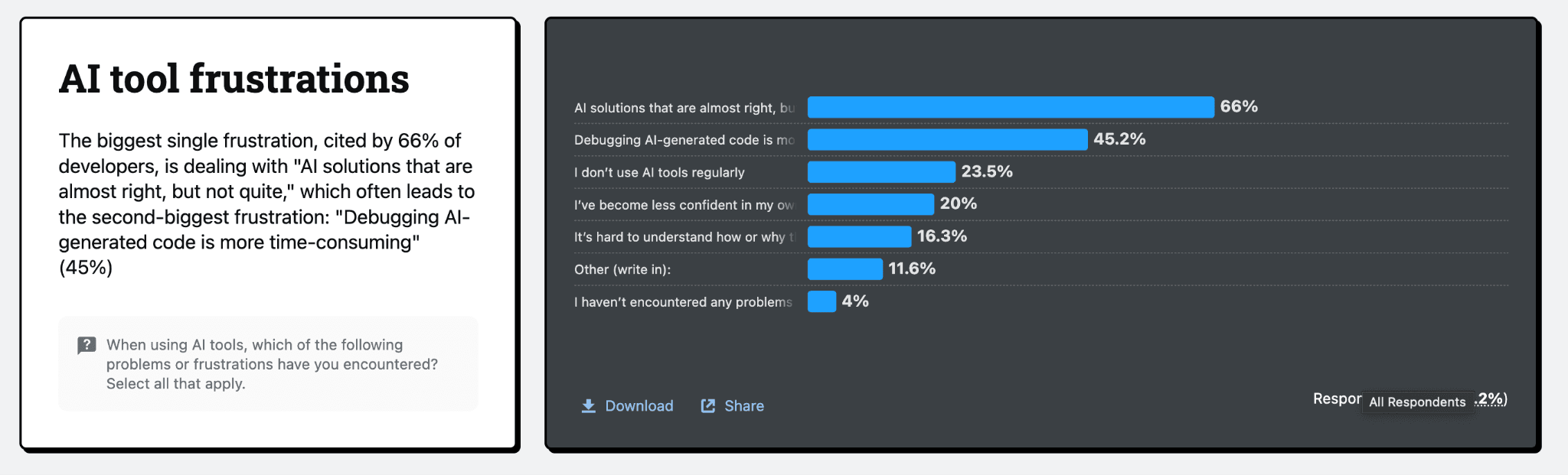

The Stack Overflow survey identified the biggest frustrations developers face with AI tools. About 66% of developers report that "AI solutions are almost right, but not quite" - meaning the code looks correct but contains subtle errors that take time to find and fix.

The second biggest problem, reported by 45% of developers, is that "debugging AI-generated code is more time-consuming" than writing code from scratch. This finding supports the research showing that AI tools slow down experienced developers rather than helping them.

Other common issues include reduced confidence in problem-solving skills (20% of developers) and difficulty understanding how AI-generated code works (16%). These problems suggest that AI tools may actually harm developer skills over time.

Why AI Tools Fail in Real-World Development

The METR study investigated 20 potential factors that might explain why AI slows down developers. They found evidence that several issues contribute to the problem:

AI tools don't understand company-specific requirements like coding standards, security rules, or business needs. This means developers must spend extra time reviewing and fixing AI-generated code to meet their organization's standards.

AI systems struggle with large, complex projects that require long-term planning and understanding of how different parts of the codebase work together. The study focused on mature open-source projects with millions of lines of code - exactly the type of work that experienced developers handle daily.

Security and compatibility issues also create delays. AI-generated code may miss important security requirements or fail to work properly with existing libraries and tools. Developers must spend additional time testing and fixing these problems.

Trust Issues Persist Despite High Usage

Despite these problems, according to Stack Overflow, 84% of developers still use or plan to use AI tools, with 51% using them daily. However, 75% of developers say they would still ask human colleagues for help when they "don't trust AI's answers." This suggests that even frequent AI users recognize its limitations and rely on human verification for important work.

The research shows a clear pattern: while AI tools are widely adopted, they often create more work than they eliminate. The gap between marketing promises and actual performance continues to grow as developers gain more experience with these tools in real-world situations.

Financial and Economic Expert Perspectives

Financial analysts and economists have raised significant concerns about the current AI market, with many drawing alarming comparisons to previous technology bubbles. Their warnings highlight the potential risks of the current AI investment surge.

Economists Warn of Extreme Market Conditions

Torsten Slok, chief economist at Apollo Global Management, has issued one of the most direct warnings about current market conditions. He stated that today's market is "even more unrealistic" than the conditions seen during the 2000 dot-com bubble. This comparison is particularly troubling given the massive losses that occurred when the dot-com bubble burst.

AI stocks are even more over-valued than dot-com stocks were in 1999-Torsten Sløk, chief economist at Apollo Global Management Fortune

Slok's analysis focuses on how AI-related companies are trading at price-to-earnings ratios that exceed even the dangerous levels seen at the peak of the dot-com era. His warning suggests that current AI stock valuations have reached unsustainable levels that mirror or exceed the speculation that led to the 2000 crash.

AI Investment Distorts Economic Growth

Economist Paul Kedrosky has provided detailed analysis of how AI spending is affecting broader economic indicators. His research found that AI spending contributed an estimated 40% of U.S. GDP growth in a recent quarter. This massive contribution has essentially propped up an otherwise weak economy. Futurism

Kedrosky characterized this phenomenon as a "massive private sector stimulus program" that is driving economic numbers higher. However, he noted a critical problem with this AI-driven growth: it has "yet to actually make anyone any money" in terms of net profits. This disconnect between massive spending and actual profitability mirrors patterns seen in previous bubbles.

The economist's analysis suggests that the current economy is heavily dependent on AI investment to maintain growth. If AI investment were to slow sharply, it could expose broader economic weakness that has been hidden by the AI spending surge. This scenario worries policymakers because it could trigger wider economic problems.

Industry Veterans Offer Optimistic Counterpoint

Tech industry veterans provide a more optimistic perspective, often drawing lessons from the dot-com era. Many recall that while the dot-com bubble caused massive company failures, the underlying internet technology ultimately transformed the world and created enormous value over time.

These industry leaders argue that AI follows a similar pattern where short-term market volatility shouldn't overshadow the technology's genuine transformative potential. They point to continuous AI research breakthroughs and improving performance on complex tasks as evidence that AI will unlock new commercial applications.

Academic Voices Urge Caution on AGI Claims

In academic circles, experts have focused on tempering unrealistic expectations about artificial general intelligence. Sam Altman himself has tried to manage AGI expectations, calling the term "not super useful" and encouraging focus on "incremental progress" instead.

This academic perspective emphasizes the importance of realistic assessments of current AI capabilities. Research from companies like Apple has highlighted significant limitations in advanced AI models, including their tendency to suffer "total collapse" on certain complex tasks. These findings contribute to a more balanced view that counteracts excessive hype while acknowledging genuine progress.

What is Sam Altman's view on the AI bubble?

Sam Altman, the CEO of OpenAI and one of the most influential figures in artificial intelligence, has been remarkably candid about his belief that the AI industry is currently in a bubble. His perspective carries significant weight because he leads the company behind ChatGPT and has a direct stake in AI's success.

Altman Confirms We Are in an AI Bubble

When directly asked whether investors are overexcited about AI, Altman gave a clear answer: "My opinion is yes." This straightforward admission from someone at the center of the AI boom was seen as unusually honest for a tech CEO who benefits from continued AI investment.

Altman draws explicit parallels between today's AI excitement and the dot-com bubble of the late 1990s. He explained that "when bubbles happen, smart people get overexcited about a kernel of truth." During the dot-com era, the internet was genuinely transformative technology, but enthusiasm ran far ahead of what was actually possible at the time.

Altman sees the same pattern happening with AI today. "Tech was really important. The internet was a really big deal. People got overexcited," he noted. In his view, AI represents a similar situation where the underlying technology is revolutionary, but current market behavior has become irrational.

Criticism of Current Funding Environment

Altman has been particularly critical of how venture capital and investors are throwing money at unproven AI ventures. He called it "insane" that some AI startups with just "three people and an idea" are commanding extremely high valuations worth hundreds of millions or billions of dollars.

This behavior represents "not rational" decision-making according to Altman. He warned that "someone's gonna get burned there" and predicted that "someone is going to lose a phenomenal amount of money" when the current investment frenzy eventually corrects.

These comments reveal Altman's concern that too much speculative money is flowing into AI companies that lack solid business foundations. Unlike established companies with proven products and revenue, many AI startups are being valued based purely on future potential rather than current performance.

Optimistic Despite the Bubble

While Altman acknowledges the bubble-like conditions, his overall stance remains optimistic about AI's long-term prospects. He expressed his "personal belief... is that, on the whole, this will be a huge net win for the economy," even if some investors lose money during the inevitable correction.

Altman believes the "kernel of truth" underlying the AI bubble is genuinely transformative. Unlike pure speculation bubbles with no substance, he argues that AI technology represents real progress that will ultimately benefit society and the economy.

This perspective allows him to simultaneously warn about bubble conditions while maintaining confidence in AI's future. He sees the current period as a necessary phase of development where excessive investment will eventually lead to genuine breakthroughs and valuable applications.

Confidence in OpenAI's Survival

Despite acknowledging bubble risks, Altman has expressed bold confidence that OpenAI will emerge as one of the long-term winners. He announced plans for OpenAI to spend "trillions of dollars" on data centers in coming years, showing that he expects his company to survive and thrive through any market correction.

When economists worry about such massive spending plans, Altman's response is dismissive: "we'll just be like, 'You know what? Let us do our thing.'" This attitude suggests he views current high spending as necessary investment to build revolutionary AI capabilities.

Altman compares OpenAI's position to companies like Amazon during the dot-com era. While many internet companies failed when that bubble burst, Amazon survived and became one of the world's most valuable companies. He believes OpenAI can follow a similar path in AI.

Comments

Your comment has been submitted