Windsurf AI Drama: How a $3 Billion Coding Startup Got Split Between Google, OpenAI, and Cognition in Just 72 Hours

In just 72 hours, one of Silicon Valley's hottest AI coding startups went from a record-breaking $3 billion acquisition deal to being torn apart by tech giants in a feeding frenzy that shocked the industry. Windsurf, the AI coding tool that had captured over 1 million developers and was pulling in $82 million annually, became the center of a high-stakes battle between OpenAI, Google, and Cognition that exposed the ruthless competition driving today's AI arms race.

OpenAI wanted to buy them for $3 billion, which would have been their biggest purchase ever. But then things got messy. Microsoft got involved and ruined the deal. Anthropic stopped working with Windsurf. Google jumped in and took away their best people, and other employees were taken by another company making a complete mess of their entire business structure. What happened to Windsurf is pretty wild, and it all went down super fast.

Let's get into it.

What is Windsurf? The AI Coding Tool That Everyone Wanted

Windsurf became the second biggest AI coding tool by market share. It was first started in 2021 under the name “Exafunction” by MIT friends Varun Mohan and Douglas Chen. Later, it was rebranded to “Codeium” and then to “Windsurf” in April 2024. The company is based in San Francisco and built an AI tool that helps with coding. Its main features include Cascade, which lets AI make changes across many files, and Flows, which helps people work with AI in real time.

Windsurf focused on big companies that have huge codebases, unlike tools like Cursor that mainly target individual users. By July 2025, Windsurf had grown fast — earning $82 million per year, with over 350 enterprise clients like JPMorgan Chase and Dell, and more than 1 million developers using it. The company’s revenue from enterprise clients was doubling every few months, with strong customer satisfaction and no loss of clients.

Its tech setup allowed users to choose from different AI models like GPT, Claude, or Gemini. This flexibility gave Windsurf an edge over others who only worked with one model. With enterprise-ready features and top-level security approval (FedRamp High), Windsurf became a valuable player in the fast-growing AI coding space.

Why OpenAI Wanted to Buy Windsurf for $3 Billion?

OpenAI wanted to buy Windsurf for a few key reasons: to keep up with better coding tools from Google’s Gemini and Anthropic’s Claude, to build stronger ties with developers (not just through Microsoft), and to make ChatGPT better for tasks that use AI agents. Before this, OpenAI had tried to buy Cursor but was turned down, so Windsurf became their top choice.

Talks started in April 2025, and by May, OpenAI had agreed to a $3 billion deal. They also got a special agreement that gave them time to finish the deal without other companies stepping in, which lasted until July 11, 2025. This would have been OpenAI’s biggest deal ever and given them access to Windsurf’s fast-growing user base and business clients.

But the deal fell apart mostly because of OpenAI’s partnership with Microsoft. In 2023, Microsoft’s deal gave them rights to anything OpenAI developed or acquired. Since Microsoft’s GitHub Copilot competed with Windsurf, Windsurf’s CEO Varun Mohan didn’t want Microsoft involved at all. OpenAI asked if they could keep Windsurf’s tech private from Microsoft, but Microsoft said no. This disagreement ended the deal when the exclusivity period ended on July 11, 2025.

Google Swoops In and Takes the Best People

Google executed a masterful "reverse acquihire" immediately after OpenAI's exclusivity expired, announcing a $2.4 billion deal on Friday evening, July 11, 2025, to hire key Windsurf leadership and license the company's technology.This strategic maneuver avoided traditional acquisition regulatory scrutiny while achieving similar strategic goals.

What did Google acqui-hire?

Google specifically acquired CEO Varun Mohan, co-founder Douglas Chen, and approximately 40 senior R&D staff members focused on "agentic coding"—AI systems that act as autonomous development partners. The deal provided Google with non-exclusive licensing rights to Windsurf's technology while integrating the acquired talent into DeepMind's Gemini coding initiatives.

The Google deal occurred with remarkable speed, completed within hours of OpenAI's exclusivity expiration. However, it faced criticism for reportedly excluding employees who had joined Windsurf within the last year from financial participation, focusing primarily on leadership and senior researchers while leaving most of the 250-person team behind.

What Happened to the Rest of Windsurf

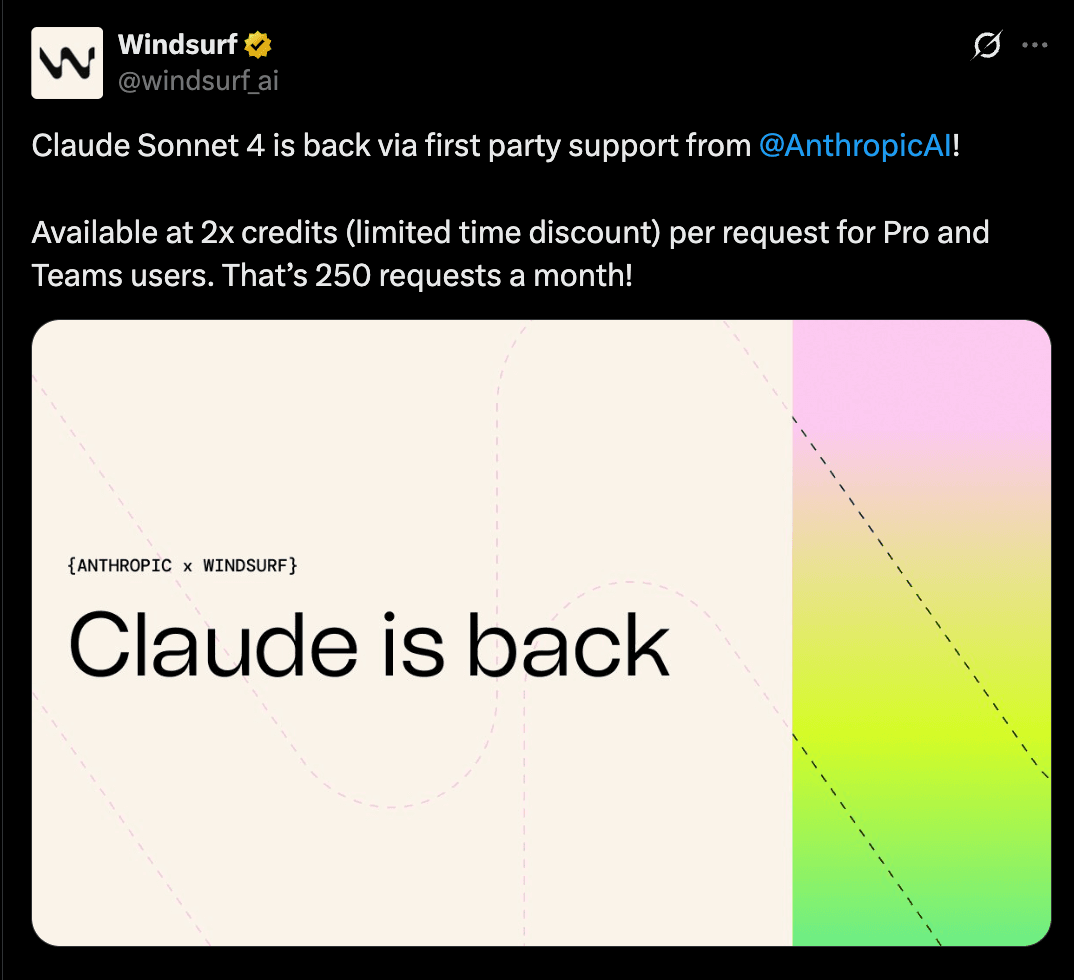

Image source: Windsurf

Cognition entered the picture after Google's announcement, negotiating and completing a definitive agreement to acquire Windsurf's remaining assets within 72 hours. The first call with Cognition occurred after 5 PM on Friday, July 11, and by Monday morning, July 14, 2025, the deal was announced following an all-hands meeting at 11 AM PT.

What does Cognition get?

Cognition's acquisition included Windsurf's intellectual property, product, trademark, brand, and all remaining employees (approximately 210 people after Google's departures). The deal also encompassed the $82 million ARR business with 350+ enterprise customers and hundreds of thousands of daily active users.

Cognition made sure that all Windsurf employees got a share of the deal, fixing the issue that happened with Google, where new employees were left out. They removed the usual waiting period for stock options and gave credit for the work already done. This meant Windsurf employees were treated the same as Cognition’s current team. This people-first approach was very different from how most tech companies do buyouts and helped keep the team united during the big changes.

The Hidden Drama: Why Anthropic (Claude) Got Involved

There’s a hidden story behind Windsurf’s rumored $3 billion deal with OpenAI. Anthropic, the company behind Claude AI, suddenly stopped giving Windsurf direct access to its popular models, Claude 3.5 and 3.7 Sonnet. Jared Kaplan, Anthropic’s co-founder, said they made this choice because OpenAI is their biggest competitor. If OpenAI buys Windsurf, he said, it wouldn’t make sense to keep selling Claude to them.

Windsurf had to quickly find other providers to keep things running. They said this change might cause some short-term problems for users. Anthropic also explained they are low on computing power right now and want to save it for long-term partners. However, Kaplan added that Anthropic is working with Amazon to add more computing power soon.

Even though no one has confirmed the deal, this move by Anthropic shows how competitive and careful the AI world has become.

Windsurf Current status and integration plans

Windsurf's corporate structure has been permanently altered through its split across two major acquirers. The Google-acquired leadership team, including CEO Varun Mohan and co-founder Douglas Chen, now works within DeepMind on Gemini's agentic coding capabilities,strengthening Google's position against Microsoft's GitHub Copilot and OpenAI's coding initiatives.

Under Cognition's ownership, Windsurf continues operating with Jeff Wang serving as interim CEO and Graham Moreno as President.The company maintains its $82 million ARR business and 350+ enterprise customers while gradually integrating with Cognition's Devin AI coding agent.Importantly, Windsurf regained full access to Anthropic's Claude models under Cognition's ownership, resolving the June 2025 complications that had forced customer migrations.

The integration strategy involves combining Windsurf's established IDE technology with Cognition's autonomous coding agent capabilities, creating a comprehensive AI coding platform positioned to compete with both established players like Cursor (valued at $9 billion) and emerging competitors in the rapidly consolidating AI development tools market.

Windsurf Complete timeline of events

2021-2024: Foundation and Growth

- 2021: Company founded as "Exafunction" by Varun Mohan and Douglas Chen

- 2024: Pivoted to AI coding assistance, achieved FedRamp High certification, rebranded to "Windsurf"

February-April 2025: Rapid Expansion

- February: Windsurf raising at $2.85 billion valuation

- April: Reached $100 million ARR (up from $40 million), OpenAI began acquisition talks

April-May 2025: OpenAI Negotiations

- April 16: CNBC first reported OpenAI's $3 billion acquisition talks

- May 5: Bloomberg reported OpenAI reached agreement

- May: OpenAI entered exclusivity period

June 2025: Anthropic Complications

- June 3: Anthropic reduced Windsurf's Claude model access with less than 5 days' notice

- June 5: Anthropic co-founder publicly stated concerns about selling Claude to OpenAI

- Impact: Several customers migrated to competitors like Cursor

July 11-14, 2025: The 72-Hour Collapse

- Friday, July 11: OpenAI exclusivity expired; Google announced $2.4 billion deal for leadership

- Weekend: Windsurf executives negotiated with multiple suitors, with Cognition offering strongest terms

- Monday, July 14: Cognition signed definitive agreement, announced at 11 AM PT

Conclusion

The Windsurf story is pretty crazy when you think about it. A company that was doing great suddenly got torn apart by big tech companies fighting over AI tools. OpenAI wanted to buy them for $3 billion, but Microsoft's partnership rules killed the deal. Then Google swooped in and took the best people, leaving everyone else behind, and then another company came up and hired the employees of the company.

What makes this story interesting is how fast everything happened. In just 72 hours, Windsurf went from being one company to being split between Google and Cognition. The people who built the company are now working at Google, while the actual product and remaining workers ended up at Cognition.

This whole mess shows us something important about the AI world right now. Big companies are willing to do almost anything to get the best AI tools and people. They're not just competing - they're going to war over this stuff. And smaller companies, even successful ones like Windsurf, can get caught in the middle and torn apart.

Comments

Your comment has been submitted