We Analyzed 50+ AI Tools - These 13 Are Actually Worth It for CFOs [2026 Guide]

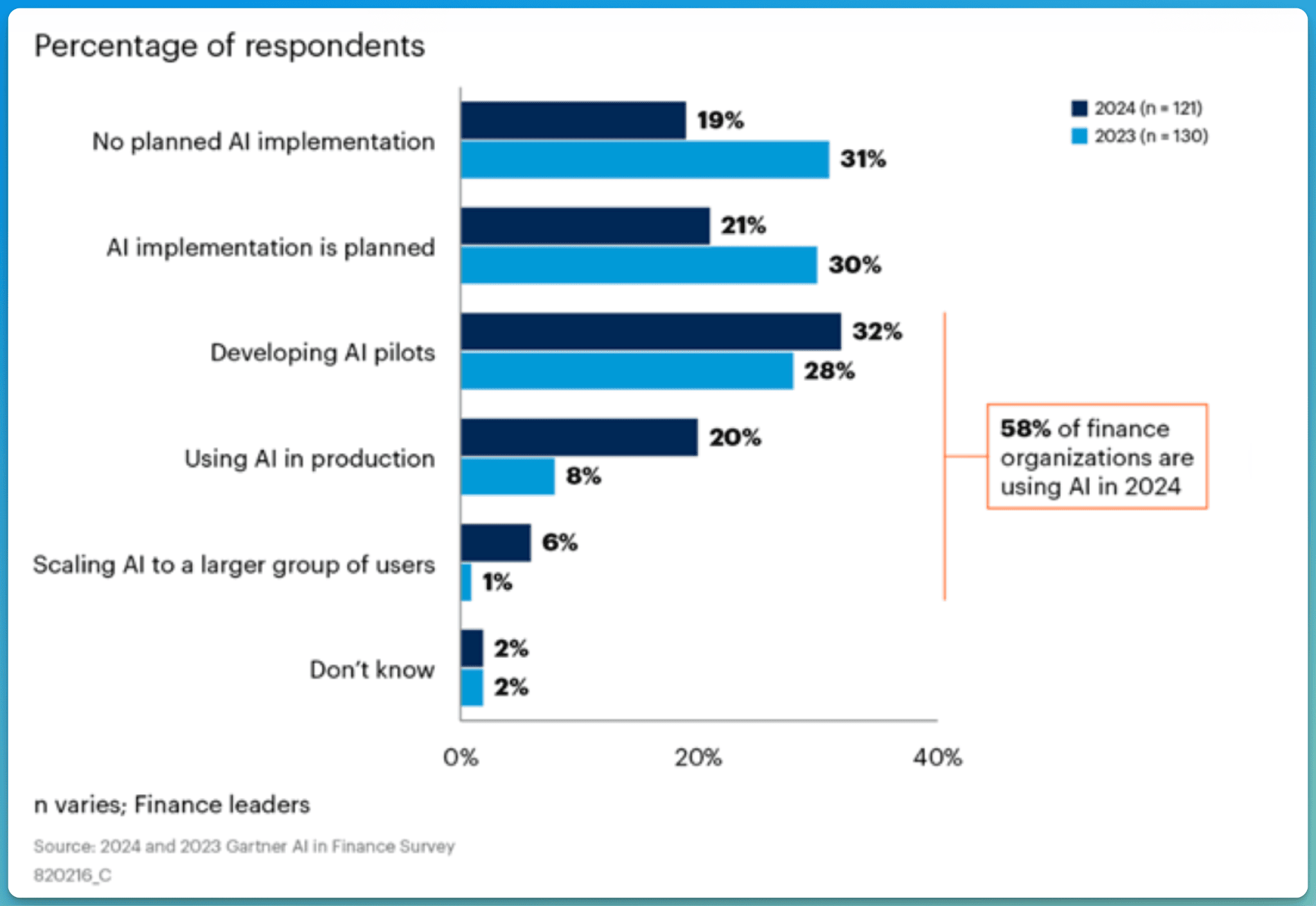

According to a Gartner survey of finance leaders, 58% of finance functions are now using AI in 2024, up from just 37% in 2023. This shows AI adoption in finance is growing fast, and it's time for CFOs to explore the best AI tools available to stay competitive.

In this article on the best AI tools for CFOs, we'll explore everything you need to know about these powerful AI Tools that are changing finance operations.

Here is what we are going to cover:

- AI tools for CFOs organized by specific use cases

- How AI actually improves finance functions with real processes

- 13 top AI tools including Elephas, Anaplan, Numeric, and more

- What each tool does best and who should use it

- Pricing and User feedback details for each platform

By the end of this article, you'll understand which AI tools match your specific finance needs, whether you want faster month-end closes, better forecasting, or secure offline document analysis.

Let's get into it.

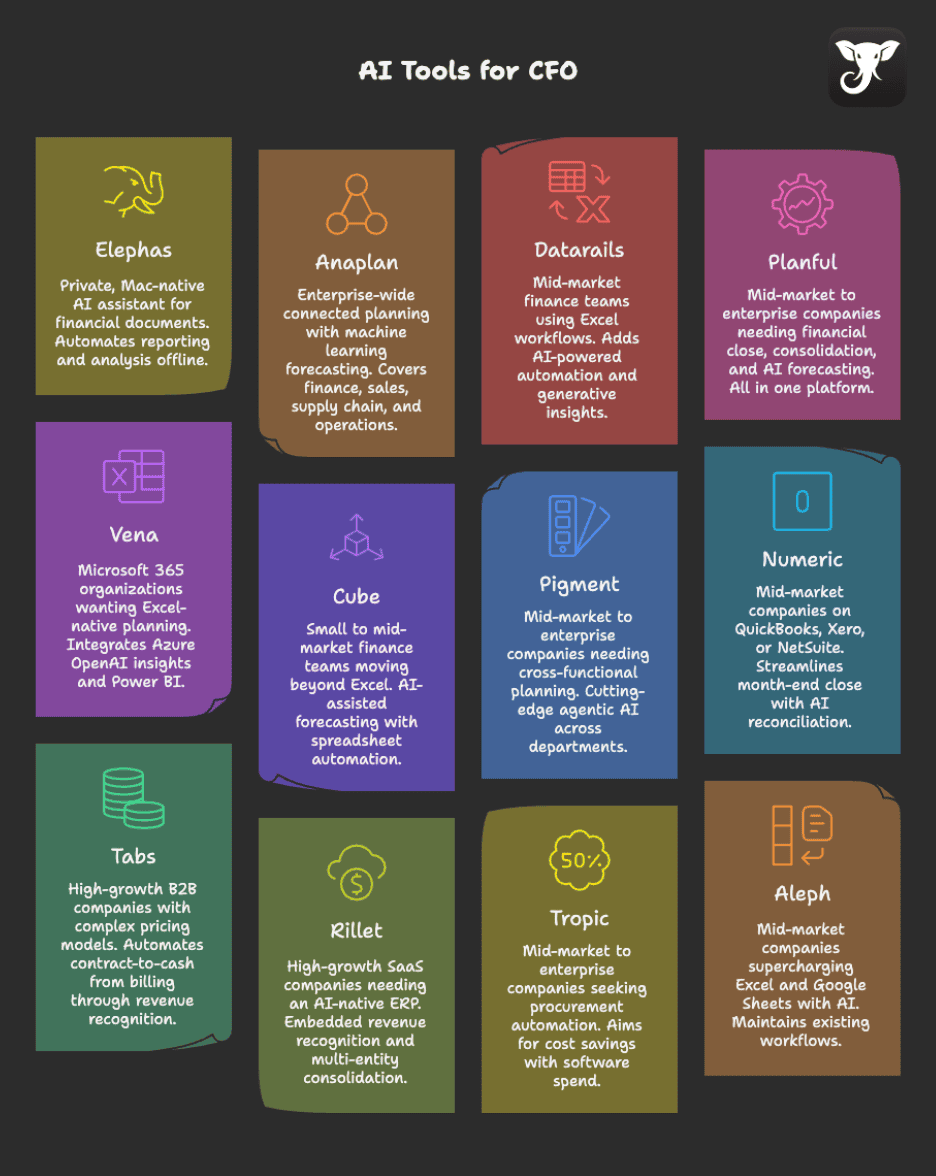

Best AI Tools for CFOs by Use Case

- Financial Planning & Forecasting: Anaplan, Planful, and Pigment help create budget predictions and business plans with smart AI insights.

- Month-End Close & Reporting: Numeric speeds up monthly closings with automated checks. Elephas summarizes board reports and creates presentations fast while keeping data private on your Mac.

- Excel & Spreadsheet Work: Datarails, Vena, and Cube connect your spreadsheets to live data. Elephas automates repetitive tasks in spreadsheets without sending files to the cloud.

- Private Financial Document Work: Elephas works completely offline for analyzing sensitive financial documents, strategic plans, and budget files with full privacy.

- Contract & Billing Management: Tabs handles invoicing and revenue tracking. Tropic cuts software costs by finding better deals.

- Elephas stands out for CFOs who need AI help but want financial data to stay secure on their own device.

1. Elephas

Best for — Finance leaders needing a private, Mac-native AI assistant that works completely offline with financial documents while automating reporting, analysis, and knowledge management tasks.

Elephas is a AI knowledge assistant built specifically for Mac users who handle sensitive financial information and need intelligent automation without cloud dependency. Elephas changes how CFOs capture, organize, and access financial data through its Super Brain feature, which creates a personal knowledge repository right on your Mac. This approach ensures complete data privacy since all processing happens locally on your device.

Elephas supports multiple AI providers including OpenAI, Claude, and Gemini, giving finance teams flexibility in how they interact with financial data. Elephas features AI-powered workflows with specialized agents that automate repetitive finance tasks like summarizing board reports, extracting insights from financial documents, and generating presentations.

Key Features:

- Super Brain is a personal knowledge base that captures and organizes financial documents, board reports, budget files, and strategic plans with semantic search across all stored information for instant retrieval of critical financial data

- AI workflow automation with specialized agents for multi-step financial tasks including automated variance analysis, financial report summarization, diagram creation for presentations, and PDF form filling for regulatory filings

- Multiple AI provider support with seamless switching between OpenAI, Claude, Gemini, Groq, etc.

- Complete offline functionality with local embeddings having 100 percent offline use, ensuring financial data never leaves your device while maintaining full AI capabilities for sensitive information processing

- Professional writing tools with four rewrite modes including Professional Mode for board communications, Smart Write for generating financial content, Grammar Fixes for error-free reports, and Smart Reply for quick email responses

Pricing: $9.99/month

Why We Picked Elephas

From a CFO perspective, Elephas solves the critical challenge of leveraging AI for financial operations while maintaining absolute data privacy and security. Users can run an offline-first architecture that means sensitive financial information, strategic plans, and board materials never leave your Mac, eliminating concerns about data leaks or compliance violations. The Super Brain feature acts as a memory system, allowing CFOs to instantly retrieve insights from years of financial documents, past board presentations, and strategic planning materials.

The workflow automation capability replaces hours of manual work on routine financial tasks like variance explanation, report generation, and data extraction from multiple sources. Implementation is immediate since Elephas runs directly on your Mac without complex setup or IT involvement.

User Feedback:

I purchased a lifetime subscription around 2 years ago. Elephas has significantly enhanced my customer relationships by refining my tone and professionalism in written communication. The ability to swiftly outline key points and tap the Elephas button has greatly improved my writing. Elephas transforms my rants and rambles into well-crafted, friendly or professional responses, saving me a lot of time and making me seem like a nice person. (Seriously) [sensitive content hidden] always offers prompt, kind, and supportive assistance whenever I encounter issues that I've created. He might be using Elephas too ;-) The program updates have kept pace with advancements in AI.— Capterra

I use the Elephas app regularly in the medical field, mainly to work with PDFs of scientific articles. The app is reliable, stable, and supports me excellently in my daily work. I especially appreciate how efficiently it helps me search and process medical content.— Capterra

2.Anaplan

Best for — Enterprise-wide connected planning with advanced machine learning forecasting across finance, sales, supply chain, and operations.

Anaplan is an enterprise-grade financial planning and analysis platform that combines strategic, operational, and financial planning in real time. The platform connects planning across all departments, breaking down silos between finance, sales, HR, and supply chain teams. PlanIQ is Anaplan's flagship AI add-on that uses advanced time-series forecasting and machine learning to generate predictive insights.

The system leverages Amazon Forecast technology with multiple ML algorithms to provide highly accurate financial and operational predictions. CFOs gain access to CoPlanner, a generative AI assistant that delivers conversational insights and recommendations. Anaplan handles complex multi-dimensional business planning, supporting rolling forecasts, capital expenditure planning, and profitability analysis across global operations.

Key Features:

- PlanIQ AI-powered forecasting with multiple algorithms including DeepAR+, Prophet, ARIMA, CNN-QR, ETS, and MVLR with AutoML and Ensemble capabilities for automatic model selection based on data patterns

- Connected planning platform with Hyperblock in-memory calculation engine enabling real-time collaboration across Finance, Sales, Supply Chain, HR, and Operations departments

- Unlimited scenario modeling and what-if analysis with multi-dimensional modeling capabilities allowing CFOs to test strategic decisions and see impacts across the entire organization

- Anaplan Optimizer with advanced linear optimization algorithms and 30+ predictive analytics algorithms for complex constraint-based planning and resource allocation

- Built-in explainability features providing transparency into forecast drivers with automatic data quality checks, performance metrics, and clear documentation of AI decision-making

Pricing: Custom pricing

Why We Picked Anaplan

From a CFO perspective, Anaplan stands out for its ability to unify planning across the entire organization. The platform delivers true connected planning where finance leaders can see how changes in one department ripple through the entire business model. PlanIQ's six different ML algorithms ensure CFOs get the most accurate forecasts possible by automatically selecting the best approach for their data.

The built-in explainability means finance teams can trust and defend the AI-generated predictions to boards and investors. Implementation takes only 2.5 weeks for PlanIQ, delivering quick time to value. The platform scales with enterprise complexity while maintaining audit-ready controls and SOC 2 compliance.

User Feedback:

"Anaplan is a tool that is easy to use, not only for end users but also for developers building planning applications. The structure, building blocks, and user-friendly ("Excel-like") modeling interface make this tool suitable for a wide range of use cases, from financial forecasting and sales performance to supply chain." — G2 Review

"Anaplan does not integrate seamlessly with third party platforms given its limited API. Therefore, it is difficult to sync data between Anaplan and our Snowflake data warehouse in real-time. However, we are able to schedule data syncs between the two platforms on a predefined cadence." — G2 Review

3. Datarails

Best for — Mid-market finance teams who want to maintain Excel workflows while adding AI-powered automation and generative insights.

Datarails is an FP&A platform built specifically for Excel users who need automation without abandoning their spreadsheet models. The platform automates data consolidation, reporting, and planning while maintaining full Excel functionality through the Datarails Flex add-in. FP&A Genius is its breakthrough AI suite featuring a ChatGPT-style chatbot that answers questions in plain English using company financial data.

The system integrates with over 200 data sources including ERPs, CRMs, and HRIS systems to create a single source of truth for financial reporting. FP&A Genius includes three capabilities: Insights for automated summaries, Storyboards for AI storytelling with visualizations, and Chat for conversational budget and forecast queries. CFOs can ask direct questions and receive instant data-driven answers without manual spreadsheet work.

Key Features:

- FP&A Genius generative AI assistant with three capabilities including Insights for automated financial summaries, Storyboards for AI-powered storytelling and dashboards, and Chat for conversational queries about budgets and forecasts

- 100 percent Excel-native platform through Datarails Flex add-in that maintains full Excel functionality while adding cloud consolidation, automation, and collaboration without forcing teams to abandon existing models

- Automated data consolidation from 200+ sources including QuickBooks, NetSuite, Xero, Salesforce, and HRIS systems with automated categorization, mapping, and real-time integration

- Financial reporting and dashboards with real-time updates, customizable PowerPoint storyboards, unlimited report outputs, drill-down capabilities, and variance analysis

- Collaborative budgeting and forecasting with workflows for budget collection, scenario modeling, version control, and automated variance analysis comparing actuals to plan

Pricing: Custom pricing

Why We Picked Datarails

From a CFO perspective, Datarails solves a critical challenge faced by mid-market finance teams: how to add AI and automation without disrupting existing Excel workflows. The Excel-native approach means finance teams can continue using the models they have built over years while gaining instant access to consolidated data and AI insights.

FP&A Genius provides conversational AI that pulls exclusively from trusted company data, unlike ChatGPT which lacks this security. Implementation averages just two weeks, allowing CFOs to see immediate value. The platform delivers audit-ready reporting with complete data integrity and version management, supporting SOX, Basel III, and DFAST compliance requirements.

User Feedback:

"The output is exactly what our business is looking for and we will be able to save a lot of time in month end with our automated FP&A system rather than using the old excel model." — Capterra Review

"Some look ups do not always work and you really have to sort it out on the back end as to what happened, when sometimes you just want your data" — Capterra Review

4. Planful

Best for — Mid-market to enterprise companies needing comprehensive financial close, consolidation, and AI-powered forecasting in one unified platform.

Planful is a cloud-based FP&A platform designed to streamline financial processes and drive better decision-making across the organization. The platform combines financial close, consolidation, planning, and analytics in one unified environment. Planful Predict is its AI suite featuring Predict Signals for error and anomaly detection and Predict Projections for AI-powered forecasting using historical data.

The system automates error checking and creates unbiased forecasts informed by machine learning algorithms. Planful Predict Signals continuously monitors data for anomalies in formulas, projections, and financial data, helping teams catch mistakes before reports are published. Predict Projections creates objective forecasts based purely on historical trends and AI analysis, eliminating human bias from the forecasting process.

Key Features:

- Planful Predict AI suite with two modules including Predict Signals for automatic anomaly detection and error identification, and Predict Projections for AI-driven forecasting using proprietary machine learning algorithms with minimum 24 months historical data

- Financial consolidation and close automation with multi-entity consolidation, intercompany eliminations, currency conversion, and automated data collection and validation to speed month-end processes

- Rolling forecasts and scenario planning with real-time visibility into financial metrics, unlimited what-if scenarios, and driver-based modeling for flexible strategic planning

- Cash flow forecasting with advanced visibility into cash balances, ability to adjust key drivers, and real-time cash position management for better liquidity planning

- Structured planning templates with pre-built roll-up logic supporting top-down, bottom-up, and zero-based budgeting methodologies for different planning approaches

Pricing: Custom pricing

Why We Picked Planful

From a CFO perspective, Planful offers a complete financial performance management platform with transparent, explainable AI. The Predict Signals module acts as a continuous quality assurance system, catching errors and anomalies before they reach board presentations or regulatory filings. Predict Projections delivers bias-free forecasts that CFOs can defend with confidence, showing exactly how the AI arrived at its conclusions.

The platform handles complex multi-entity consolidations with automated currency conversions and intercompany eliminations. Implementation takes 6 to 12 weeks, with Planful Now offering critical use cases in under 30 days. The system maintains SOC 2 Type II, ISO 27001, and GDPR compliance with enterprise-grade security.

User Feedback:

"Planful has been really useful for simplifying forecasting and actuals tracking across multiple projects. I especially like how it lets us update projections in real time and compare them against actual costs as they come in. For our nonprofit, where we manage a mix of government and private funding, this gives us a much clearer picture of how we’re tracking against budget." — G2 Review

"The planning feature was almost impossible to use. Any new features were always only available at a price never as part of what we already were paying for. The integrators were oversold and never worked despite being paid for. The consolidation functionality roll over made January month end more painful than our annual audit process, and take almost as long." — Capterra Review

5. Vena

Best for — Microsoft 365 organizations wanting Excel-native planning with Azure OpenAI-powered insights and seamless Power BI integration.

Vena is a Complete Planning platform that integrates tightly with Microsoft Excel and Power BI, allowing finance teams to work within familiar tools. The platform connects spreadsheets to a centralized cloud database while maintaining full Excel functionality. Vena Copilot is its AI assistant powered by Azure OpenAI that allows users to ask financial questions and generate reports using natural language.

The system provides AI-powered predictive analytics, anomaly detection, and customizable data models tailored to each business. Vena Copilot uses multiple specialized AI agents including Planning Agent, Analytics Agent, Reporting Agent, and Query Agent for different FP&A tasks. CFOs can request financial data or generate reports using conversational prompts, making advanced analytics accessible to non-technical users.

Key Features:

- Vena Copilot agentic AI with multiple specialized agents powered by Microsoft Azure OpenAI providing natural language interface for FP&A insights, automated report generation, scenario analysis, and conversational queries

- Vena Insights AI-powered self-service reporting built on Power BI with pre-built dashboards, drill-downs, real-time analytics, and automated variance analysis

- Excel-native platform with true native Excel integration maintaining full spreadsheet functionality while connecting to centralized CubeFLEX OLAP engine in the cloud

- Collaborative workflows with real-time co-authoring, workflow automation, task assignments, reminders, approval tracking, and version control for team coordination

- Unlimited scenario modeling with driver-based planning, multi-scenario comparison, what-if analysis, and version control for strategic decision-making

Pricing: Custom Pricing

Why We Picked Vena

From a CFO perspective, Vena delivers enterprise-grade planning within the Excel environment that finance teams already know. The Azure OpenAI integration provides cutting-edge generative AI capabilities while maintaining enterprise security standards where data is never used to train public models. Vena Copilot can be trained on historical company data to improve accuracy and relevance over time.

The platform provides complete auditability of all AI interactions with admin controls. Implementation takes 6 to 8 weeks for standard deployments. Vena maintains SOC 1 Type II, SOC 2 Type II, and GDPR compliance with data residency options in Canada, US, and EU. The Excel-native approach minimizes training time and accelerates user adoption.

User Feedback:

"As a financial analyst part of sales team, in my organisation this excel based interface has made my processes more easier, and automated with strong collaboration. This vena tool is extremely helpful for those work in financial companies like myself, by coordination of enterprise finance teams like budgeting, forecasting made more intuitive and easier process to work on." — G2 Review

"The worst part of working in Vena is its interface which is a little different to learn initially and getting used to its complex user interface takes a little time also the price of the software is on the higher side when it is compared to some other planning software. Overall, the value feels pretty low since the system is really complicated, and every little thing you want to add requires paid support." — Capterra Review

6. Cube

Best for — Small to mid-market finance teams moving beyond Excel who want AI-assisted forecasting with spreadsheet-native automation.

Cube is an FP&A software tool that automatically syncs financial data to Excel and Google Sheets, eliminating the need to start from blank spreadsheets. The platform connects ERP, HRIS, and CRM systems directly to familiar spreadsheet interfaces, providing a single source of truth. With Cube's Agentic AI, finance teams never start from scratch because the AI takes the first pass at plans and reports.

The system offers AI-assisted forecasts, scenario modeling, automated data validation, and proactive variance analysis, all while working within the spreadsheet interface. Cube speeds up consolidation cycles by 50 percent and cuts planning cycle times in half. The platform handles multi-currency operations with custom exchange rates for global businesses.

Key Features:

- Spreadsheet-native integration with seamless bi-directional sync to Excel and Google Sheets allowing finance teams to work in familiar environments while accessing centralized, real-time data

- Automated data consolidation pulling data from ERPs, CRMs, HRIS systems in real-time, eliminating manual data entry, VLOOKUP formulas, and data quality issues

- AI-powered forecasting and variance analysis with agentic AI that generates forecasts, automates variance analysis, and provides conversational AI via Slack and Teams for natural language queries

- Multi-scenario planning with ability to create and compare unlimited budget scenarios, forecasts, and what-if analyses with complete version control and audit trails

- Financial close acceleration reducing consolidation cycles by 50 percent and planning cycle times in half through automated data flows and validation

Pricing: Custom Pricing

Why We Picked Cube

From a CFO perspective, Cube offers the fastest path from Excel chaos to organized, automated planning without forcing teams to abandon spreadsheets. The platform ranks number one on G2 for implementation speed, with most teams up and running in days to three weeks. The AI-powered variance analysis provides the first draft of variance explanations, helping CFOs identify where to focus deeper investigation.

Automated data validation catches errors before they reach reports. Founded by a former CFO, Cube understands the challenges finance teams face. The platform maintains SOC 2 Type II and GDPR compliance with encryption, SSO, role-based access controls, and complete audit logs. Customer support via dedicated Slack channels is highly responsive.

User Feedback:

"Cube is extremely simple to setup and easy to learn. I've worked with many FP&A tools in the past (IBM TM1 and Biznet are examples), but Cube has been my favorite thus far. TM1 is known as the powerhouse FP&A tool, but came with many tech headaches that required outsourcing of setup to consulting firms. Cube on the other hand was implemented in a matter of days, with no external consultants." — Software Advice Review

"It's frustrating when a task that sometimes takes ten minutes can stretch to take two days because load times are pushing 18 hours and fail out... The only flaw that I find is something they've communicated that they're constantly working to improve, which is speed to load or fetch data. It can be time consuming to update and process a bunch of different reports." — TrustRadius Review

7. Pigment

Best for — Mid-market to enterprise companies needing cross-functional planning with cutting-edge agentic AI across finance, sales, HR, and supply chain.

Pigment is a collaborative business planning and FP&A platform built to handle large datasets and enable multi-dimensional modeling across the organization. The platform connects finance, sales, HR, and supply chain planning with shared metrics and a unified data hub. Pigment features four specialized AI agents: Analyst, Planner, Modeler, and Supervisor that autonomously analyze data, build scenarios, update models, and provide recommendations.

The system enables CFOs to simulate infinite what-if scenarios with AI-powered insights and reverse-engineer target outcomes. Finance professionals in The F Suite community describe Pigment as adding 1 to 2 analyst-equivalents of output for lean teams. The distributed engine scales to handle complex, multi-dimensional models with 30+ native connectors to ERPs, CRMs, and HRIS systems.

Key Features:

- Agentic AI suite with four specialized agents including Analyst for data scanning and trend detection, Planner for translating insights into actions, Modeler for autonomous model building, and Supervisor for orchestrating workflows

- Real-time integrated planning connecting finance, sales, HR, and supply chain with shared metrics, unified data hub, and cross-functional collaboration for organization-wide alignment

- Advanced scenario modeling simulating infinite what-if scenarios with AI-powered insights, reverse-engineering target outcomes, and comparing multiple scenarios side-by-side

- Cross-functional collaboration with built-in commenting, filtering, real-time co-editing, and departmental workflows enabling finance, operations, and leadership to work together

- Flexible data architecture with distributed engine scaling to handle complex multi-dimensional models, 30+ native connectors, and ability to integrate custom data sources

Pricing: Custom pricing

Why We Picked Pigment

From a CFO perspective, Pigment has agentic AI for financial planning. The four specialized AI agents work autonomously to analyze data, suggest plans, build models, and coordinate tasks, functioning like additional team members. The platform delivers 306 percent ROI over three years according to a Forrester study. Pigment excels at cross-functional planning, allowing CFOs to connect revenue forecasts to hiring plans, marketing spend to pipeline growth, and operational metrics to financial outcomes.

The metadata structure makes it easier to scale planning while maintaining control. Implementation takes several weeks to three months with comprehensive onboarding. Pigment maintains SOC 1 Type 2, SOC 2 Type 2, CSA STAR Level 1, GDPR, CCPA, and SOX compliance with granular access controls.

User Feedback:

"Pigment has been life changing. The ease of creating dashboards and key metrics, along with the flexibility within the tool, is second to none. Adaptive has not changed their product in recent years and went stale. Pigment is the best in class right now. Unparalleled Flexibility: Pigment stands out with its remarkable flexibility, allowing us to craft budgets and plans with ease." — Capterra Review

"Challenging to get used to at first... becoming fully autonomous on the tool takes time. Lots of options can lose the beginner user. A little more expensive than other tools, but no other major cons. Pigment being a rather new solution on the market, there is always a need for developing partnerships with consulting firms." — G2 Review

8. Numeric

Best for — Mid-market companies on QuickBooks, Xero, or NetSuite looking to streamline month-end close with AI-powered reconciliation and flux analysis.

Numeric is an AI-powered close management platform that accelerates month-end close with automated reconciliations, AI-driven flux analysis, and intelligent close checklists. The platform integrates directly with ERPs to provide live data connections with auto-reconciliation capabilities. AI-powered flux analysis auto-drafts variance explanations and identifies core drivers of variance, saving hours during month-end close.

The system provides ongoing transaction monitoring for continuous close processes and custom reporting capabilities. CFOs in The F Suite community consistently endorse Numeric for speeding up close cycles and improving visibility. The platform includes a Technical AI Assistant that can generate accounting policies, draft memos grounded in latest accounting standards, and respond to technical accounting questions.

Key Features:

- AI-powered flux analysis that auto-drafts variance explanations, identifies core drivers of variance, and generates narrative commentary to save hours during month-end close

- Automated reconciliations with live ERP integration, auto-reconciliation capabilities, AI-parsing of bank statements, and notifications when accounts no longer reconcile

- Close management and task tracking providing project management for month-end, quarter-end, and year-end with segregation of duties between preparers and reviewers

- Transaction monitoring with ongoing monitoring for continuous close process, custom reporting capabilities, and real-time alerts for unusual transactions

- Technical AI assistant that generates accounting policies, drafts memos grounded in latest accounting standards, and responds to technical accounting questions for audit support

Pricing: $30/month

Why We Picked Numeric

From a CFO perspective, Numeric solves one of the most painful recurring challenges in finance: the month-end close process. The platform delivers day one implementation, with most teams starting for free and seeing impact immediately. Numeric won G2's Winter 2024 award for Fastest Implementation in the Mid-Market Category.

The AI-powered flux analysis eliminates hours of manual variance explanation work, automatically identifying why numbers changed and drafting explanations finance teams can review and approve. CPA-led onboarding ensures the platform follows proper accounting practices. Used by companies like Brex, OpenAI, Plaid, and Wealthfront. The platform maintains enterprise-grade security with SOC 2 compliance and secure API access.

User Feedback:

"Numeric helped my team get organized quickly and easily. The implementation was painless, especially compared to other tools. We were up and running in a day, and our team grew with the product." —G2 Review

"Users find the limited functionality of Numeric restrictive, awaiting additional features for enhanced efficiency and automation. Users report occasional bugs in Numeric, which can disrupt the overall experience despite its many benefits. Users experience inefficient task management in Numeric, often forgetting to update completions and affecting workflow visibility." — G2

9. Tabs

Best for — High-growth B2B companies with complex pricing models needing contract-to-cash automation from billing through revenue recognition.

Tabs is an AI-native revenue automation platform that streamlines the entire contract-to-cash process, including billing, accounts receivable, revenue recognition, and general ledger posting. The platform uses large language models to automatically extract commercial terms from signed contracts without manual data entry. AI agents read contracts, create billing schedules, generate invoices, and sync with CRM and ERP systems.

The system supports usage-based, milestone-based, subscription, and hybrid pricing models without requiring price book updates. Collections and dunning are fully automated, with AI agents monitoring due dates, automatically matching and reconciling payments, and sending reminders. ASC 606 revenue recognition is automated with real-time tracking and built-in compliance.

Key Features:

- AI contract ingestion using large language models to automatically extract commercial terms from signed contracts, MSAs, order forms, amendments, and emails to generate billing schedules without manual data entry

- Automated billing and invoicing generating invoices directly from contracts with support for usage-based, milestone-based, subscription, and hybrid pricing models without price book updates

- Collections and dunning automation with AI agents monitoring due dates, automatically matching and reconciling payments, sending automated reminders, and providing actionable insights on overdue balances

- ASC 606 revenue recognition with automated revenue recognition schedules ensuring GAAP compliance, real-time tracking, built-in compliance verification, and direct sync to ERP

- Cash application and reconciliation automatically reconciling both analog checks and digital payments including ACH and credit cards as they arrive to accelerate month-end close

Pricing: $20/month

Why We Picked Tabs

From a CFO perspective, Tabs eliminates one of the most manual, error-prone processes in B2B finance: managing the contract-to-cash cycle. The AI contract ingestion is particularly powerful for companies with complex pricing models, automatically extracting terms from unstructured documents and creating billing schedules.

This eliminates the bottleneck of manual contract processing that often delays revenue recognition. The platform goes live in less than 30 days with guided implementation. CFOs in The F Suite community call it a game-changer, with one stating it completely automated their contract-to-cash process.

User Feedback:

"I like it that Tabs has helped us speed up our billing processes by automating contracts processing. With the help of AI, we can save our time in doing manual tasks from customer creation, entering customer data and invoice creation. One cool thing as well is that it sends automated reminders when we have to send the invoices or remind collections to our customers.." — G2

“The Stripe and tabs integration doenst do everything that I would like for it to do. The cash application process definitely took a lot of time and conversations to nail down. I have to double check reports for accuracy.”. — G2 Reviews

10. Rillet

Best for — High-growth SaaS companies needing an AI-native ERP with embedded revenue recognition, multi-entity consolidation, and real-time metrics.

Rillet is an AI-native ERP platform built specifically for SaaS companies, featuring embedded revenue recognition, automated reconciliations, multi-entity accounting, and real-time financial data. The platform automates 93 percent of manual journal entries and accounting processes with AI bank transaction matching and reconciliation. Unlike NetSuite which takes 6 to 9 months to implement, Rillet can be implemented in as fast as 4 weeks.

The system closes books in hours versus weeks, with PostScript closing in just 3 days. Finance professionals in The F Suite community call it a true ERP challenger built by accountants for accountants. The platform handles multiple entities, geographies, and currencies with automated foreign exchange re-evaluations and consolidated multi-currency reporting. Native SaaS metrics like ARR, NRR, logo retention cohorts, and burn calculations are generated automatically from ledger data.

Key Features:

- AI-powered automation that automates 93 percent of manual journal entries and accounting processes with AI bank transaction matching, reconciliation, and suggested coding

- Revenue recognition engine with automated ASC 606 compliance, usage-based billing support, real-time revenue waterfall, and Stripe and CRM integration for automatic calculation

- Multi-entity consolidation handling multiple entities, geographies, and currencies with automated FX re-evaluations, intercompany eliminations, and consolidated multi-currency reporting

- Automated month-end close with built-in checklist, AI reconciliations, and processes that reduce close time from weeks to hours, 4.8 times faster than traditional ERPs

- Native SaaS metrics with real-time ARR, NRR, logo retention cohorts, churn analysis, and burn calculations generated automatically from ledger data without manual spreadsheet work

Pricing: Custom pricing

Why We Picked Rillet

From a CFO perspective, Rillet is a modern alternative to legacy ERPs like NetSuite and QuickBooks. The platform is built specifically for SaaS business models with native support for recurring revenue, usage-based billing, and SaaS metrics. Implementation is 4.8 times faster than traditional ERPs with white-glove service from a team of CPAs and ex-auditors. One F Suite member reported Rillet cut their close cycle to a couple of days and halved audit prep time.

The platform includes 1 to 2 years of historical data migration. Rillet raised over $100 million in under a year in 2026, backed by Sequoia and Andreessen Horowitz. The platform maintains SOC 2 Type II and GDPR compliance with multiple layers of data encryption and audit logs. Perfect five-star rating on G2 with a 10.0 score for Quality of Support.

User Feedback:

"Rillet let us build our finance stack from scratch—the right way. As CFO, I've worked with NetSuite (bloated, expensive) and QuickBooks (rigid, limited). Rillet is in a different category entirely. The platform is fast, intuitive, and beautifully modern. I now have real-time visibility into our financials, our bank data flows in automatically, and our Stripe integration just works. Their team also understands accounting." — G2 Review

"I wish they had forecasting as well so I wouldn't need to transfer the data into my forecasting software. It needs this module to be the one stop shop for all finance functions. Rillet's burn calculations are not as flexible as I need them to be so I still do that part manually." — G2 Reviews

11. Tropic

Best for — Mid-market to enterprise companies with $250,000+ annual software spend seeking procurement automation and 20 to 30 percent cost savings.

Tropic is an AI-powered procurement and spend management platform that automates vendor negotiations, contract management, and provides supplier intelligence backed by $13 billion or more in spend data. The platform gives CFOs access to SKU-level price benchmarks and negotiation playbooks from thousands of actual deals. AI agents automatically extract contract details, track renewals, spot shadow spend, and flag compliance issues.

The system detects shadow IT through AI-powered analysis of unauthorized software purchases across the organization. CFOs can see which renewals to renegotiate, duplicate spend to cut, and overpayment opportunities with actionable tools. Companies handle 200 to 600 renewals per year on average, making automation essential. Over 500 customers including Zapier, Plaid, and Notion use Tropic to manage $10 billion or more in spend.

Key Features:

- AI-powered supplier intelligence with access to $13 billion or more spend dataset providing SKU-level price benchmarks, negotiation playbooks, and market comparisons from thousands of actual deals

- Automated spend management with AI agents that automatically extract contract details, track renewals, spot shadow spend, and flag compliance issues across the organization

- Procurement workflow automation with dynamic approval workflows, automated intake forms, supplier onboarding, contract lifecycle management, and policy enforcement

- Purchase prep and savings identification showing which renewals to renegotiate, duplicate spend to cut, overpayment opportunities, and actionable recommendations with tools to execute

- Shadow IT detection using AI-powered analysis to identify unauthorized software purchases, unused licenses, and redundant tools across the organization for cost optimization

Pricing: $3167/month

Why We Picked Tropic

From a CFO perspective, Tropic is a immediate ROI by reducing software spend by 20 to 30 percent through better negotiation and duplicate elimination. The platform provides market intelligence that in-house teams simply cannot access, with price benchmarks from $13 billion or more in actual spend data. This levels the playing field when negotiating with vendors. Finance professionals in The F Suite community highlight meaningful time and cost savings, especially for teams without dedicated procurement.

The platform automates the entire procurement workflow, from intake through contract execution. The platform includes a Supplier Code of Ethics ensuring no kickbacks or commissions influence recommendations. Implementation takes weeks with dedicated account managers providing support.

User Feedback:

"Being able to see where the spend is and when contracts are coming due are the 2 biggest benefits in my opinion. Having all spend in one place and being able to get reminders when it's time to start looking at replacement vendors. Also, being able to compare what others are spending to negotiate a lower price. Tropic has been one of the highest ROI initiatives we've ever deployed on the finance team at Zapier." — G2 Reviews

"The process needs refinement. As legal, our team receives constant notifications to approve certain matters but often times there are no legal documents updated. In cases documents are updated, the legal team is not updated in real time. Afterward, legal receives a notification that approval is past due and that lack of approval blocks a few other workflows. This conflict causes a unnecessary fire drill for legal review without adequate time." — G2 Reviews

12. Aleph

Best for — Mid-market companies wanting to supercharge Excel and Google Sheets with AI while maintaining existing workflows and spreadsheet models.

Aleph is an AI-powered FP&A platform that enables natural language queries of financial data, automates reporting, and provides collaborative planning directly within Excel and Google Sheets. The platform features bi-directional spreadsheet integration through native add-ins that sync data in real-time. Finance teams can keep existing financial models while adding live data connections with version control and audit trails built in.

The system connects 150+ no-code data connectors to seamlessly integrate ERP, HRIS, CRM, and cross-system data. AI-powered variance analysis called AI Scan automatically spots and explains variances in seconds with data drill-downs to root causes. CFOs in the Bain Capital Ventures CFO Advisory Board highlight Aleph for rapid implementation, with teams up and running basically the day after the demo.

Key Features:

- Bi-directional spreadsheet integration with native Excel and Google Sheets add-ins that sync data in real-time, maintain existing financial models, and provide version control and audit trails

- 150+ no-code data connectors seamlessly integrating ERP, HRIS, CRM, and cross-system data with real-time or scheduled synchronization and pre-built data models

- AI-powered variance analysis with AI Scan that automatically spots and explains variances in seconds, provides data drill-downs to root causes, and eliminates manual lookup tables

- Automated financial reporting and close turning days of manual work into click-of-button tasks, completing quarter-end reporting in under 3 weeks from signing

- Enterprise-grade security with SOC 2 Type II certification, continuous monitoring, annual audits, third-party penetration testing, data encryption in transit and at rest, and fine-grained access controls

Pricing: Custom pricing

Why We Picked Aleph

From a CFO perspective, Aleph solves the challenge of adding AI and automation to Excel workflows without forcing teams to abandon the spreadsheets they have perfected over years. The implementation speed is industry-leading at less than 3 weeks, with some customers reporting being up and running the same week.

The AI Scan feature reduces 90 percent of time-consuming variance analysis busywork by automatically identifying changes and explaining root causes. Finance professionals praise the ability to query financial data conversationally and generate intelligent predictions, automating basic modeling tasks.

User Feedback:

"What I like about Aleph is the intuitive nature of the application. It has helped us evolve our data analytics very much. The customer service has also been great. The team is very responsive and always finds solutions to our problems. The implementation process was also fast and seamless. That was a big priority on our end.” G2 Review

"Although the real time sync is fast, every refresh requires 10-15 mins for data to be extracted. There are certain customization constraints, export limitations and I feel definitely a learning curve to get up and running in Aleph. They are still working through some kinks and bugs, and the Google Sheets integration struggles sometimes." — G2 Review

13. Runway

Best for — Startups and high-growth companies needing top-line planning with 750+ integrations and the most modern, user-friendly AI-driven interface.

Runway is an AI-driven scenario planning and modeling platform designed for top-line planning, featuring multi-dimensional data integration across sales and marketing to connect forecasts to revenue. The platform integrates with 750+ business tools in real-time, providing automated actuals updates with new financial data. Ambient Intelligence provides proactive insights without prompting, with automatic budget versus actuals variance detection and driver explanations in plain language.

Runway Copilot is the generative AI assistant that allows CFOs to type prompts and create business plans instantly using live data from all connected systems. The platform models financial strategies in seconds with natural language scenario generation. Finance professionals praise the 50 times to 100 times efficiency improvement, with hours-long tasks reduced to seconds. The company has grown 20 times in revenue over the last 12 months.

Key Features:

- 750+ business tool integrations with real-time data sync from accounting systems like QuickBooks, NetSuite, Xero, Sage Intacct, HRIS including Rippling, Gusto, BambooHR, and CRM connectivity with automated actuals updates

- Ambient Intelligence providing proactive insights without prompting, automatic budget versus actuals variance detection, driver explanations in plain language, scenario comparison summaries, and contextual recommendations

- Runway Copilot generative AI for natural language scenario generation, typing prompts to create business plans instantly, using live data from all connected systems to model financial strategies in seconds

- Multi-scenario planning with ability to compare unlimited scenarios side-by-side, drag-and-drop to explore outcomes instantly, no model duplication required, and real-time impact calculations on runway, burn, and margins

- Interactive dashboards and reporting with board-ready visualizations, real-time auto-updating reports, budget versus actuals analysis at vendor level, clean modern UI, and ability to embed reports in Notion and Slack

Pricing: Custom Pricing

Why We Picked Runway

From a CFO perspective, Runway has the highest number of integrations in the FP&A category at 750+, ensuring finance teams can connect every data source without custom development. The Ambient Intelligence approach moves beyond traditional chatbots, proactively surfacing insights rather than waiting for users to ask questions. Implementation averages 4 to 5 weeks from kickoff to full deployment.

The platform is designed for accessibility, with a consumer-grade interface that normal people who are not accountants can use. Runway has grown 20 times in revenue over the last 12 months with strategic partnership with Rippling.

User Feedback:

"Runway is an incredibly flexible tool with an easy learning curve compared to other tools in the class. The time to value is extremely quick - weeks vs. months with other tools, and is actually quite fun to build in. The number of available integrations is second to none, there is no other tool I am aware of that has anywhere close to the number of connections available. With these connectors, I can pull in any data source I want and build a true finance copilot." — G2 Review

"Runway is still quite early in its journey. The product can be unstable at times, but it is nothing too bad. The team is always extremely quick to jump on any issues. There is a learning curve associated with the software, requiring a huge investment of time to fully get to know its features. The permissioning system could benefit from more granularity, and users mentioned the lack of support for weekly splits." — G2 Review

How Does AI Tools Actually Improve Finance Functions?

The best AI tools for CFOs handle specific tasks that normally take hours of manual work. These tools don't just speed things up - they completely change how finance work gets done.

Take month-end closing work. Numeric connects to your accounting system and automatically checks if accounts match up. It writes the first draft of variance explanations so you don't start from scratch. What used to take a week now finishes in days.

What the best AI tools for CFOs actually do:

- Read contracts automatically - Tabs pulls payment terms and dates from signed contracts without typing anything manually

- Spot spending problems - Tropic scans all software purchases to find duplicate tools and unused licenses

- Explain number changes - Datarails looks at your budget versus actual spending and writes why things changed

- Work offline privately - Elephas analyzes financial documents on your Mac without sending data anywhere

The best AI tools for CFOs also handle forecasting differently. Anaplan runs six different prediction methods on your data and picks the most accurate one automatically.

Elephas summarizes board reports and pulls key numbers from old documents instantly using its memory system, all while keeping everything private on your device.

Conclusion

The best AI tools for CFOs are already changing how finance teams work. They handle boring repetitive tasks, catch errors before they become problems, and give finance leaders more time for strategy instead of manual data work. Tools like Numeric speed up closings, Anaplan improves forecasting accuracy, and Tabs automates billing processes.

Privacy matters too. If you handle sensitive financial information and want AI help without cloud risks, Elephas works completely offline on your Mac while still giving you powerful automation features.

Start by picking one problem area in your finance workflow. Then choose from the best AI tools for CFOs that solves that specific challenge. Most platforms offer quick setup and show results within weeks. The sooner you start, the faster your team can work smarter instead of harder.

You can try Elephas for free

Comments

Your comment has been submitted